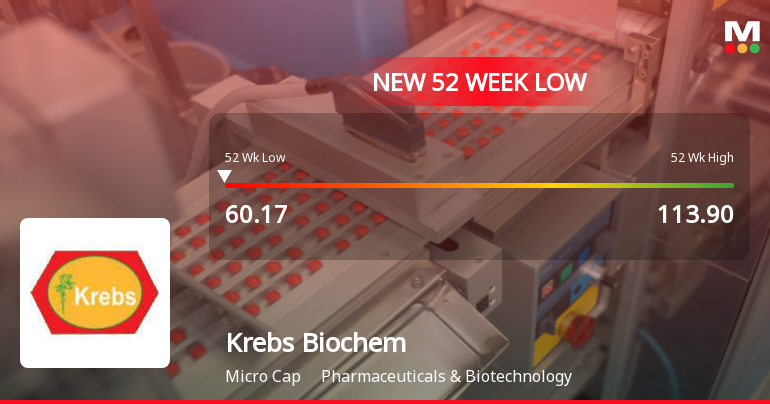

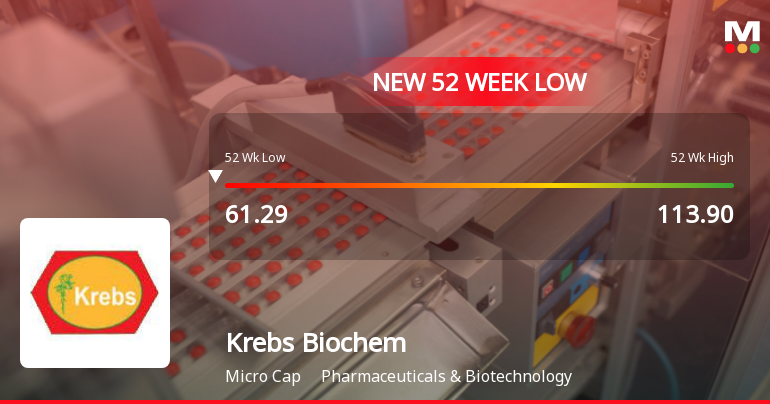

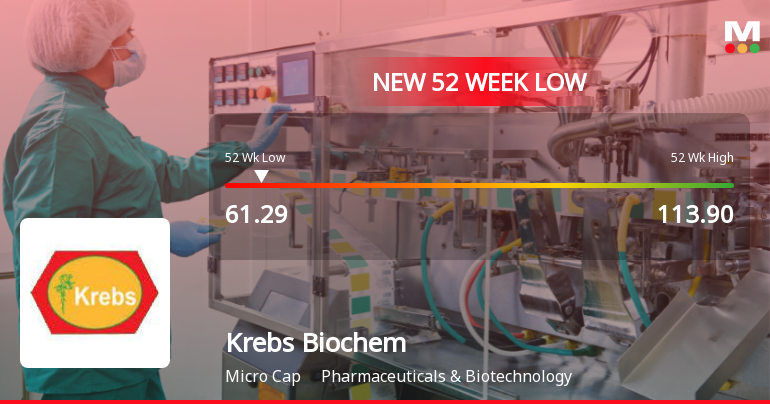

Short-Term Price Movement and Market Context

The stock’s recent performance has outpaced its sector by 0.41% on the day, and it has delivered a 5.43% return over the past four trading sessions. This upward trend contrasts with the broader market, where the Sensex declined by 0.52% over the last week. Over the past month, Krebs Biochemicals has gained 5.13%, significantly outperforming the Sensex’s 0.95% rise. These figures suggest that investors are showing renewed interest in the stock in the near term, possibly driven by technical factors or short-term trading strategies.

However, the stock remains below its longer-term moving averages, including the 50-day, 100-day, and 200-day averages, indicating that the broader trend remains subdued. The stock’s liquidity is ade...

Read full news article