La-Z-Boy Experiences Revision in Its Stock Evaluation Amid Mixed Financial Indicators

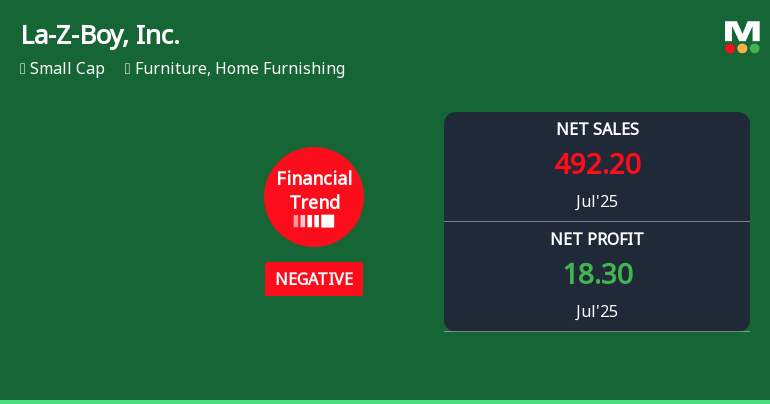

2025-11-25 15:25:08La-Z-Boy, Inc. reported a challenging quarter in July 2025, with key performance indicators reflecting operational difficulties. Despite achieving a record dividend per share and reduced raw material costs, the company faces hurdles such as declining operating cash flow, low return on capital employed, and high debt-equity ratio.

Read full news articleIs La-Z-Boy, Inc. overvalued or undervalued?

2025-11-25 11:14:44As of 21 November 2025, the valuation grade for La-Z-Boy, Inc. moved from very expensive to fair. The company is currently fairly valued based on its financial metrics. The P/E ratio stands at 13, the Price to Book Value is 1.63, and the EV to EBITDA is 4.89, which suggests that the stock is reasonably priced compared to its earnings and book value. In comparison to its peers, HNI Corp. has a P/E of 13.40 and an EV to EBITDA of 7.68, while Leggett & Platt, Inc. shows a more attractive P/E of 12.32 and an EV to EBITDA of 8.91. Notably, La-Z-Boy's recent stock performance shows a 25.80% return over the past week, significantly outperforming the S&P 500's -1.95% return in the same period, indicating positive momentum despite longer-term challenges....

Read full news article

La-Z-Boy, Inc. Experiences Valuation Adjustment Amid Competitive Market Positioning

2025-11-24 15:28:33La-Z-Boy, Inc. has recently adjusted its valuation, with its current price at $37.72, up from $36.36. Over the past year, the company has seen a 13.09% decline, while key financial metrics indicate a competitive position within the furniture industry compared to peers like HNI Corp. and Leggett & Platt.

Read full news articleIs La-Z-Boy, Inc. overvalued or undervalued?

2025-11-23 11:10:26As of 21 November 2025, the valuation grade for La-Z-Boy, Inc. has moved from very expensive to fair. Based on the current metrics, the company appears to be fairly valued. Key valuation ratios include a P/E ratio of 13, an EV to EBITDA of 4.89, and a Price to Book Value of 1.63. In comparison, HNI Corp. has a P/E of 13.40 and an EV to EBITDA of 7.68, while Leggett & Platt, Inc. shows a more attractive P/E of 12.32. Despite recent strong performance against the S&P 500 with a 1-week return of 24.24% compared to -1.95%, the longer-term outlook shows La-Z-Boy underperforming with a year-to-date return of -13.43% versus 12.26% for the index. This suggests that while the stock may be fairly valued now, its recent performance indicates potential challenges ahead....

Read full news article

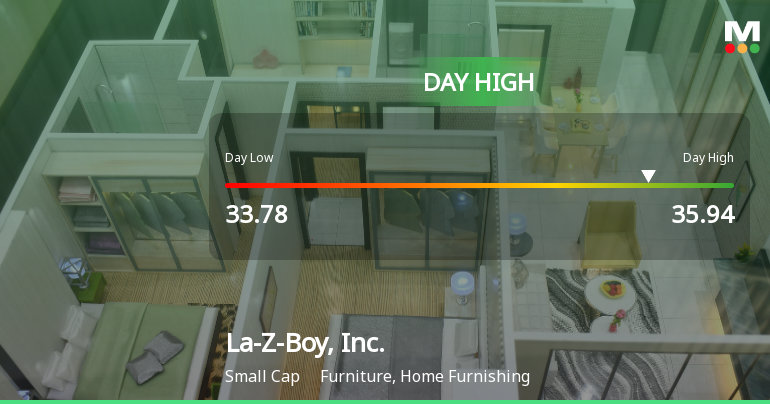

La-Z-Boy Stock Soars 20.21%, Hits Intraday High of $35.94

2025-11-20 16:53:10La-Z-Boy, Inc. has seen a notable increase in its stock price, achieving a significant gain on November 19, 2025. Despite recent short-term resilience, the company faces longer-term challenges with declines over the past year and year-to-date. Key financial metrics indicate a market capitalization of approximately USD 1,457 million.

Read full news article

La-Z-Boy, Inc. Stock Plummets to New 52-Week Low of $29.31

2025-11-18 16:49:15La-Z-Boy, Inc. has reached a new 52-week low, reflecting a significant decline in its stock performance over the past year. The company, with a market capitalization of USD 1,457 million, faces challenges in operational metrics, including low operating cash flow and a high debt-equity ratio, indicating increased leverage.

Read full news article

La-Z-Boy, Inc. Stock Plummets to New 52-Week Low of $29.93

2025-11-17 16:32:41La-Z-Boy, Inc. has reached a new 52-week low, reflecting a significant downturn amid a 1-year performance drop. The company has a market capitalization of approximately USD 1,457 million and a P/E ratio of 13.00. Financial metrics indicate challenges, including low operating cash flow and a high debt-equity ratio.

Read full news article

La-Z-Boy Stock Plummets to New 52-Week Low of $30.73

2025-11-14 15:48:30La-Z-Boy, Inc. has reached a new 52-week low, with its stock price declining significantly over the past year. The company has a market capitalization of USD 1,457 million and a P/E ratio of 13.00. Financial metrics indicate challenges, including low operating cash flow and a high debt-equity ratio.

Read full news article

La-Z-Boy Stock Plummets to New 52-Week Low of $30.77

2025-11-11 17:59:39La-Z-Boy, Inc. has hit a new 52-week low, reflecting a 1-year performance decline of 9.9%. The company has a market capitalization of USD 1,457 million, a P/E ratio of 13.00, and a dividend yield of 2.61%. Challenges include reduced operating cash flow and modest profit growth.

Read full news article