Recent Price Movement and Market Context

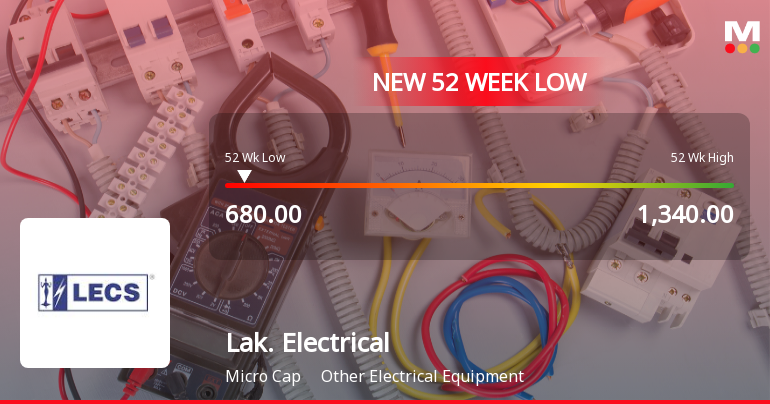

On 11 December, Lakshmi Electrical's shares advanced by ₹26.60, marking a 3.68% increase from the previous close. This rise is particularly significant given the stock's recent downward trajectory over the past month and year. While the benchmark Sensex has delivered positive returns of 1.13% over the last month and 4.04% over the past year, Lakshmi Electrical has lagged considerably, with a 9.16% decline in one month and a 42.41% drop over the last year. The stock’s year-to-date performance is also weak, down 39.22%, contrasting sharply with the Sensex’s 8.55% gain.

Despite these headwinds, the stock has shown signs of short-term resilience. Over the last three trading sessions, Lakshmi Electrical has recorded consecutive gains...

Read full news article