Recent Price Movement and Market Context

The stock’s fall on 09-Jan marks a reversal after two consecutive days of gains, signalling a shift in investor sentiment. It underperformed its sector by 1.94% on the day and traded below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages. Such technical weakness often indicates a bearish trend and can discourage short-term buying interest.

Investor participation, however, showed some increase with delivery volumes rising by over 90% compared to the five-day average on 08-Jan, suggesting heightened trading activity. Despite this, the stock’s liquidity remains adequate for sizeable trades, but the price pressure persists.

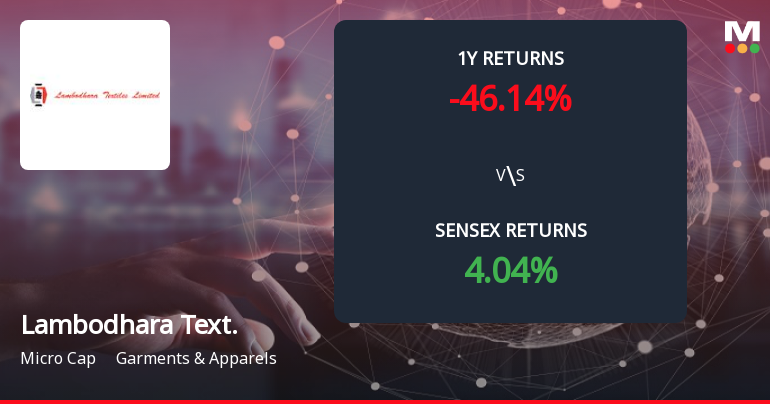

Long-Term Underperformance Against BenchmarksRead full news article