Lincoln Educational Services Corp. Experiences Revision in Its Stock Evaluation Amid Market Dynamics

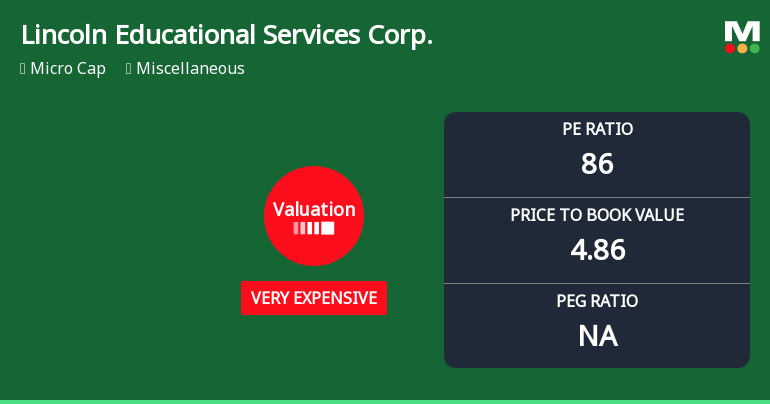

2025-11-10 15:46:41Lincoln Educational Services Corp. has adjusted its valuation, showcasing a high price-to-earnings ratio and a notable price-to-book value. The company reports solid returns on capital and equity, while its stock performance has been positive but slightly underperformed compared to the S&P 500. Its valuation stands out among industry peers.

Read full news articleNo announcement available

Corporate Actions

No corporate action available