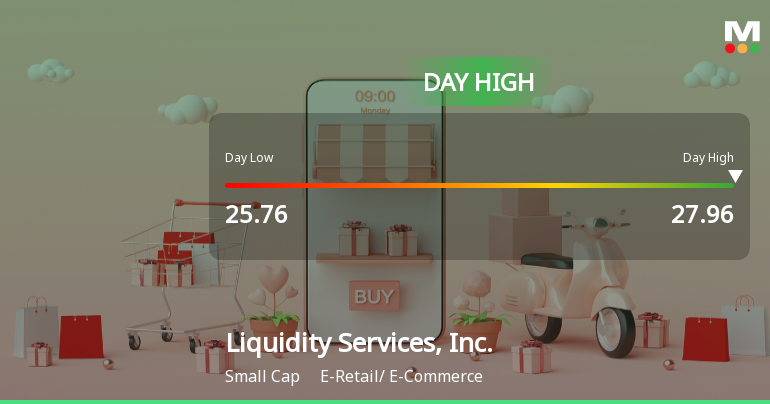

Liquidity Services Hits Day High with 8.75% Surge in Strong Intraday Performance

2025-11-24 16:43:15Liquidity Services, Inc. has shown strong stock performance, gaining 8.75% on November 21, 2025, and outperforming the S&P 500 over the past week and month. The company reported net sales of USD 236.25 million, reflecting a 27.66% growth, and maintains a high return on equity and low debt-to-equity ratio.

Read full news article

Liquidity Services Hits Day High with 13.86% Surge in Stock Price

2025-11-21 16:14:52Liquidity Services, Inc. has seen a notable increase in its stock price, reaching an intraday high on November 20, 2025. The company has outperformed the S&P 500 in recent weeks and months, despite a year-to-date decline. It demonstrates strong management efficiency and healthy long-term growth metrics.

Read full news article

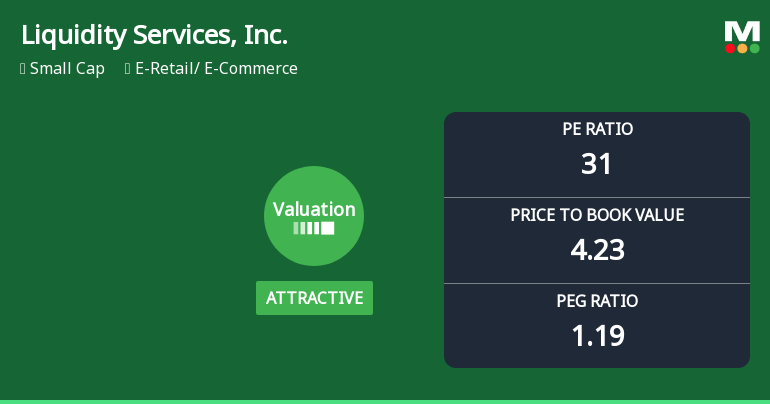

Liquidity Services, Inc. Experiences Revision in Its Stock Evaluation Amid Competitive Landscape

2025-11-10 15:47:08Liquidity Services, Inc. has recently adjusted its valuation, with a P/E ratio of 31 and a price-to-book value of 4.23. The company demonstrates strong operational efficiency, reflected in its high ROCE of 59.09% and ROE of 13.54%, positioning it favorably compared to peers in the E-Retail/E-Commerce sector.

Read full news article

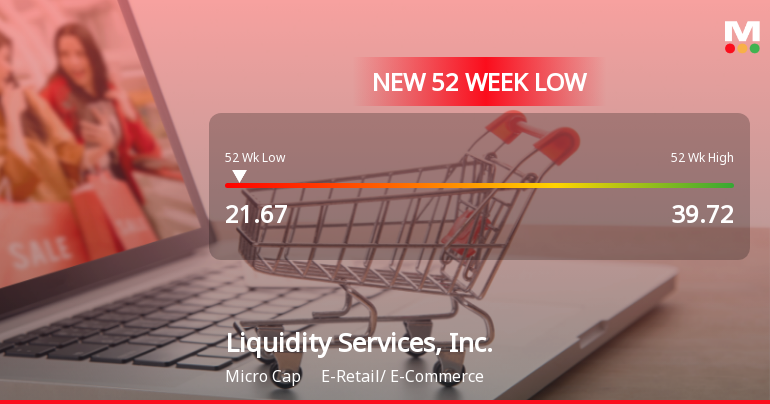

Liquidity Services, Inc. Hits New 52-Week Low at $21.67

2025-11-07 16:01:56Liquidity Services, Inc. has reached a new 52-week low, reflecting significant volatility in its stock price. With a market capitalization of approximately USD 902 million, the company has a P/E ratio of 31.00 and a return on equity of 13.27%, indicating a focus on growth over dividends.

Read full news article