Key Events This Week

23 Feb: Shares hit lower circuit amid heavy selling pressure

27 Feb: Stock surged to upper circuit on strong buying interest

Weekly Close: Rs.111.00, down 5.37% vs Sensex -0.96%

Mar 05

BSE+NSE Vol: 11.1 k

Lotus Eye Hospital & Institute Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 30 May 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 02 March 2026, providing investors with an up-to-date perspective on its performance and outlook.

Read full news article

23 Feb: Shares hit lower circuit amid heavy selling pressure

27 Feb: Stock surged to upper circuit on strong buying interest

Weekly Close: Rs.111.00, down 5.37% vs Sensex -0.96%

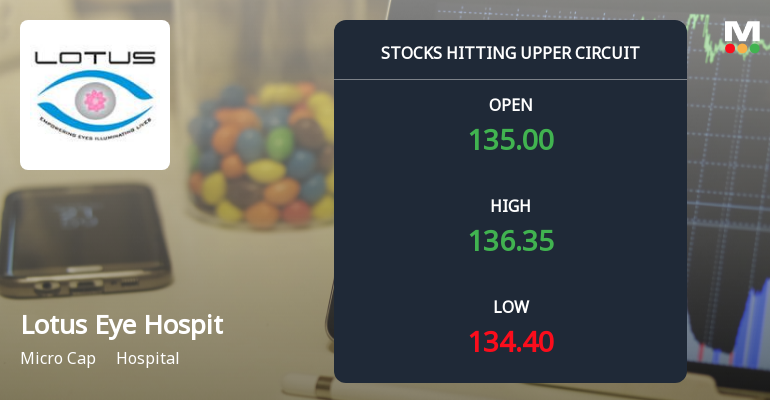

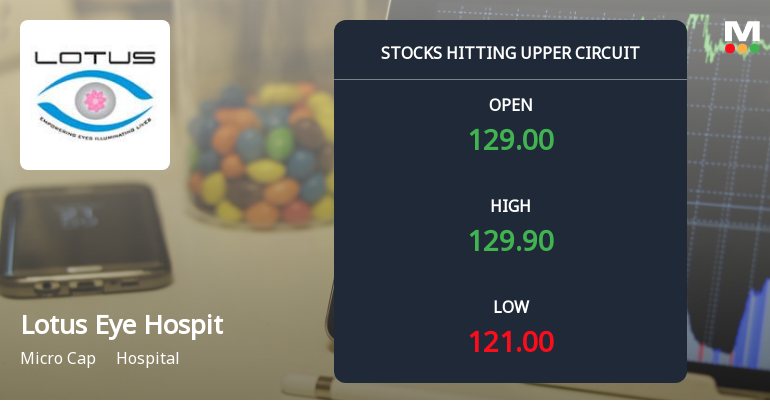

Shares of Lotus Eye Hospital & Institute Ltd surged to hit the upper circuit limit on 27 Feb 2026, propelled by robust buying interest and a significant intraday gain. The stock outperformed its sector and broader market indices, reflecting renewed investor confidence despite subdued delivery volumes and a micro-cap market capitalisation of ₹225 crores.

Read full news article

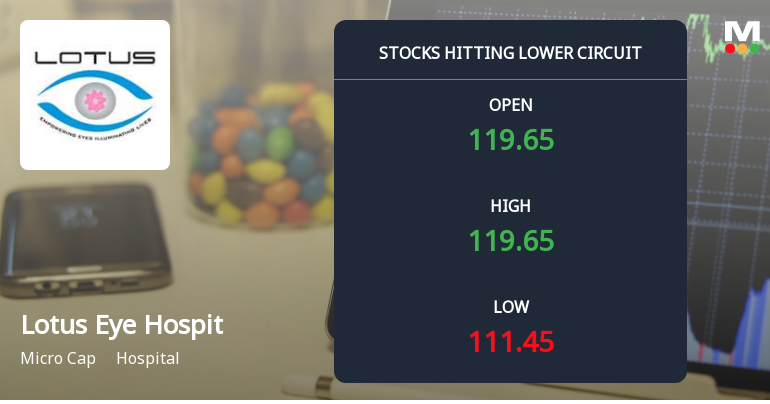

Shares of Lotus Eye Hospital & Institute Ltd plunged to their lower circuit limit on 23 Feb 2026, reflecting intense selling pressure and panic among investors. The stock closed at ₹112.88, down 3.94% on the day, marking a continuation of a sharp three-day decline that has wiped out over 13% of its value. This sudden drop underscores growing concerns about the company’s near-term prospects amid subdued investor participation and unfilled supply in the market.

Read full news article

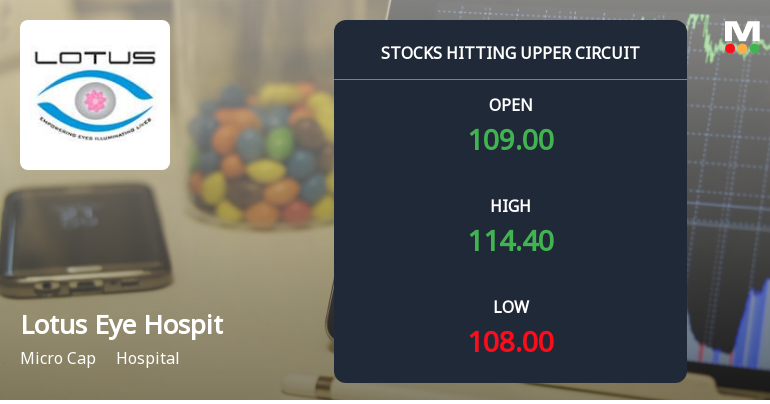

16 Feb: Stock hits upper circuit at ₹118.72 (+4.97%) amid strong buying momentum

17 Feb: Upper circuit again at ₹124.66 (+4.99%) with surge in delivery volumes

18 Feb: Third consecutive upper circuit at ₹128.60 (+4.97%), sustained investor enthusiasm

19 Feb: Fourth straight upper circuit at ₹136.70 (+4.99%), cumulative 19.48% gain

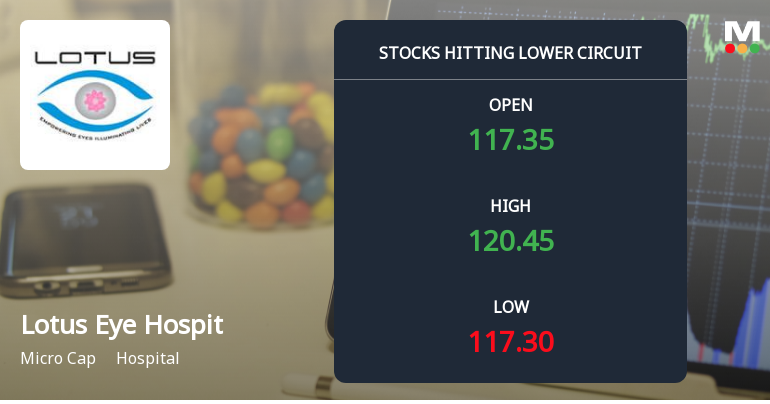

20 Feb: Shares plunge to lower circuit at ₹117.30 (-4.98%) amid heavy selling pressure

Shares of Lotus Eye Hospital & Institute Ltd plunged to their lower circuit limit on 20 Feb 2026, succumbing to intense selling pressure that saw the stock lose 3.63% intraday and close near its lowest price of Rs 117.51. The hospital sector micro-cap, with a market capitalisation of Rs 257 crores, underperformed both its sector and the broader market, reflecting mounting investor concerns and a wave of panic selling.

Read full news article

Lotus Eye Hospital & Institute Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 30 May 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 19 February 2026, providing investors with an up-to-date view of its performance and prospects.

Read full news article

Lotus Eye Hospital & Institute Ltd witnessed a significant surge in its share price on 19 Feb 2026, hitting the upper circuit limit of 5%, closing at ₹136.70. This marked the stock’s fourth consecutive day of gains, cumulatively rising 19.48%, driven by strong investor demand and heightened market participation despite a subdued broader hospital sector and Sensex performance.

Read full news article

Lotus Eye Hospital & Institute Ltd (NSE: 959118) surged to its upper circuit price limit on 18 Feb 2026, reflecting robust investor demand and sustained buying momentum. The stock closed at ₹128.60, marking a maximum daily gain of 4.97%, significantly outperforming its hospital sector peers and the broader market indices.

Read full news articleThe Exchange has received the disclosure under Regulation 10(6) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Sangeetha Sundaramoorthy

Newspaper Publication for the Financial results approved by the Board of Directors in its meeting held on February 11 2026.

Appointment of Company Secretary & Compliance Officer

No Upcoming Board Meetings

Lotus Eye Hospital & Institute Ltd has declared 5% dividend, ex-date: 18 Sep 23

No Splits history available

No Bonus history available

No Rights history available