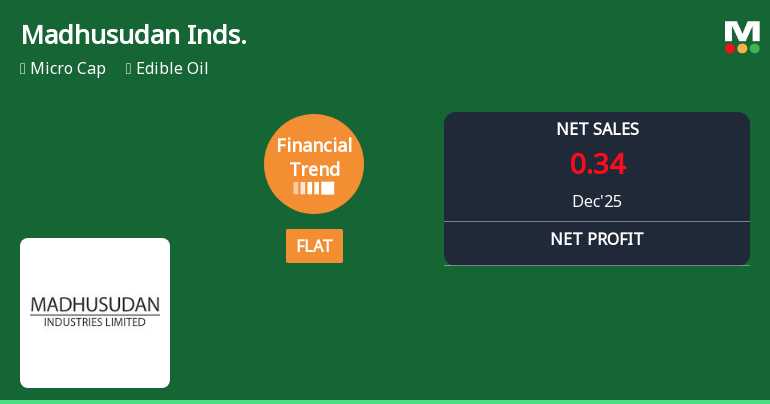

Madhusudan Industries Ltd Reports Flat Quarterly Performance Amid Margin Pressures

2026-02-11 08:00:12Madhusudan Industries Ltd, a micro-cap player in the edible oil sector, reported a flat financial performance for the quarter ended December 2025, signalling a pause in its previously negative trend. Despite some improvement in profitability and cash reserves, the company continues to grapple with weak returns on capital and margin pressures, prompting a cautious outlook from analysts.

Read full news articleAre Madhusudan Industries Ltd latest results good or bad?

2026-02-10 19:21:17Madhusudan Industries Ltd continues to face significant operational challenges, as reflected in its latest financial results. The company reported net sales of ₹0.34 crores for the quarter ended December 2025, which showed no growth compared to the previous quarter. This stagnation in revenue generation highlights ongoing difficulties in reviving its core operations, which have been virtually dormant for an extended period. The standalone net profit for the same quarter was reported at -₹0.82 crores, representing a decline of 20.59% from the previous quarter. This negative profit indicates that the company is still struggling to achieve profitability, despite a marginal improvement in the percentage change compared to the prior period. The operating profit margin, excluding other income, was recorded at 2.94%, which reflects a significant decrease of 35.30% from the previous quarter. Overall, Madhusudan I...

Read full news article

Madhusudan Industries Q3 FY26: Micro-Cap Edible Oil Player Struggles Amid Operational Challenges

2026-02-10 15:46:00Madhusudan Industries Ltd., a micro-cap edible oil company with a market capitalisation of ₹16.00 crores, continues to face significant operational headwinds as reflected in its minimal revenue generation and deteriorating financial metrics. Trading at ₹32.49 on February 10, 2026, the stock has witnessed a sharp decline of 30.43% over the past year, substantially underperforming the Sensex which gained 9.01% during the same period.

Read full news article

Madhusudan Industries Ltd Stock Falls to 52-Week Low of Rs.27.02

2026-01-27 12:36:18Madhusudan Industries Ltd, a player in the edible oil sector, has reached a new 52-week low of Rs.27.02, marking a significant decline amid a challenging market environment. The stock has underperformed its sector and broader indices, reflecting ongoing concerns about its financial health and operational performance.

Read full news article

Madhusudan Industries Ltd Stock Hits 52-Week Low Amidst Continued Downtrend

2026-01-23 15:37:55Madhusudan Industries Ltd, a player in the edible oil sector, touched a fresh 52-week low of Rs.28.01 today, marking a significant decline amid persistent downward momentum. The stock has underperformed both its sector and broader market indices, reflecting ongoing pressures on its financial and operational metrics.

Read full news article

Madhusudan Industries Ltd is Rated Strong Sell

2025-12-26 15:13:06Madhusudan Industries Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 29 May 2024. However, the analysis and financial metrics presented here reflect the company’s current position as of 26 December 2025, providing investors with an up-to-date view of its fundamentals, returns, and overall market standing.

Read full news article

Madhusudan Industries Stock Falls to 52-Week Low of Rs.30.99

2025-12-10 09:48:55Shares of Madhusudan Industries, a player in the edible oil sector, reached a fresh 52-week low of Rs.30.99 today, marking a significant decline amid broader market gains. The stock opened sharply lower and remained at this level throughout the trading session, underperforming its sector and the broader market indices.

Read full news article

Madhusudan Industries Stock Falls to 52-Week Low of Rs.31.39

2025-12-09 11:08:36Madhusudan Industries, a player in the edible oil sector, has reached a new 52-week low of Rs.31.39, marking a significant decline in its stock price amid a broader market environment where the Sensex trades near its yearly highs. This development reflects ongoing pressures on the company’s financial performance and market positioning.

Read full news article

Madhusudan Inds. Sees Revision in Market Evaluation Amid Challenging Fundamentals

2025-12-09 10:10:31Madhusudan Inds., a microcap player in the edible oil sector, has experienced a notable revision in its market evaluation, reflecting shifts in its fundamental and technical outlook. This adjustment comes amid a backdrop of subdued financial performance and persistent market pressures, underscoring the challenges faced by the company in the current economic environment.

Read full news articleAnnouncement under Regulation 30 (LODR)-Newspaper Publication

11-Feb-2026 | Source : BSENewspaper Publication dated 11/02/2026 regarding Extract of Unaudited Financial Results for the quarter and nine months ended 31/12/2025

Unaudited Financial Results For The Quarter And Nine Months Ended On 31St December 2025

10-Feb-2026 | Source : BSEUnaudited Financial Results for the quarter and nine months ended on 31st December 2025

Board Meeting Outcome for Outcome Of The Board Meeting Dated 10Th February 2026

10-Feb-2026 | Source : BSEOutcome of the Board Meeting dated 10th February 2026

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available