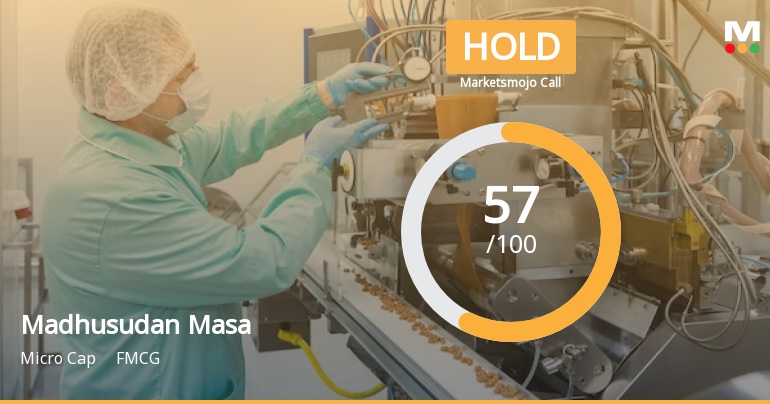

Madhusudan Masala Ltd is Rated Hold by MarketsMOJO

2026-02-08 10:10:41Madhusudan Masala Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 17 January 2026. However, all fundamentals, returns, and financial metrics discussed here reflect the stock's current position as of 08 February 2026, providing investors with an up-to-date analysis of the company’s standing.

Read full news article

Madhusudan Masala Ltd is Rated Hold by MarketsMOJO

2026-01-28 10:10:35Madhusudan Masala Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 17 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 28 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Madhusudan Masala Ltd is Rated Sell

2026-01-05 10:15:12Madhusudan Masala Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 06 October 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 05 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article

Madhusudan Masala Ltd is Rated Sell

2025-12-25 12:58:29Madhusudan Masala Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 06 Oct 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 December 2025, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article

Madhusudan Masa Sees Revision in Market Evaluation Amidst Declining Returns

2025-12-04 11:08:33Madhusudan Masa, a microcap player in the FMCG sector, has undergone a revision in its market evaluation reflecting recent shifts in its fundamental and technical outlook. This adjustment follows a period marked by subdued financial trends and notable declines in stock returns over the past year.

Read full news articleHow has been the historical performance of Madhusudan Masa?

2025-11-15 00:30:45Answer: The historical performance of Madhusudan Masa for the year ending March 2025 shows a total operating income of 230.92 crore, with a total expenditure (excluding depreciation) of 206.67 crore, resulting in an operating profit (PBDIT) of 25.63 crore. After accounting for interest and exceptional items, the profit before tax stands at 20.05 crore, leading to a profit after tax of 15.02 crore. The earnings per share (EPS) is reported at 10.38, with a diluted EPS of 10.93. The operating profit margin is 10.5%, while the profit after tax margin is 6.5%. In terms of balance sheet results, Madhusudan Masa has total liabilities of 179.06 crore, with shareholder's funds amounting to 93.66 crore. The company has long-term borrowings of 9.05 crore and short-term borrowings of 66.06 crore. Total current assets are reported at 157.73 crore, with inventories at 98.25 crore and sundry debtors at 47.16 crore. The ...

Read full news articleWhy is Madhusudan Masa falling/rising?

2025-11-15 00:03:23As of 14-Nov, Madhusudan Masala Ltd's stock price is currently at Rs. 113.35, reflecting a decrease of Rs. 14.15, or 11.1%. The stock has hit a new 52-week low of Rs. 112 today and has underperformed its sector by 11.38%. It is trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages. Additionally, there has been a significant decline in investor participation, with delivery volume falling by 44.44% compared to the 5-day average. Over the past year, the stock has generated a return of -39.04%, while the company's profits have increased by 27%. However, the high debt levels, indicated by a debt-to-equity ratio of 8.43 times, and flat operating cash flow have raised concerns among investors, contributing to the stock's downward trend. In the broader market context, Madhusudan Masala Ltd's performance has been notably poor compared to the benchmark Sensex, whic...

Read full news articleCorporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available