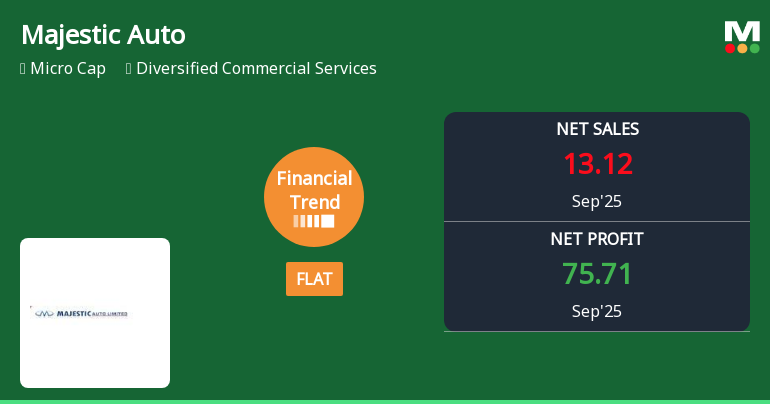

Recent Price Movement and Market Context

Majestic Auto Ltd experienced a notable decline on 23 January, reversing gains from the previous two days. The stock touched an intraday high of ₹340, marking a 2.35% increase, but ultimately fell to an intraday low of ₹320, down 3.67%. The weighted average price indicates that more volume was traded near the lower end of the day’s range, signalling selling pressure. Furthermore, the stock underperformed its sector, which itself declined by 2.19%, with Majestic Auto lagging by an additional 1.07% on the day.

Technical indicators also point to bearish momentum, as the share price is trading below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages. This suggests a sustained downtrend and we...

Read full news article