Mastercraft Boat Holdings, Inc. Experiences Revision in Stock Evaluation Amid Market Challenges

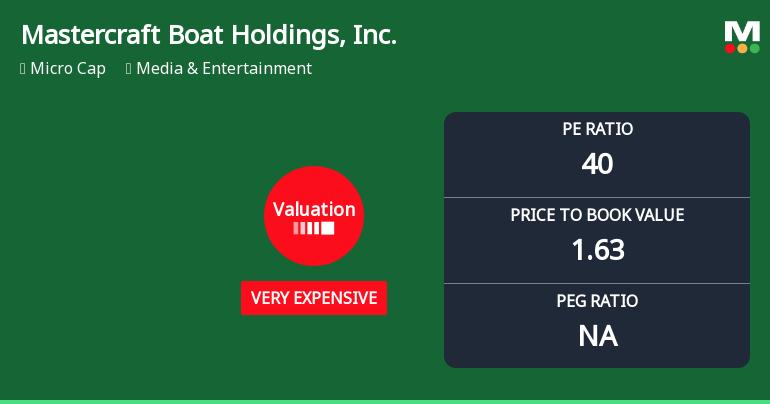

2025-11-10 16:08:42Mastercraft Boat Holdings, Inc. has recently adjusted its valuation, revealing a P/E ratio of 40 and a price-to-book value of 1.63. Compared to peers like Malibu Boats and Marine Products, Mastercraft's metrics indicate a higher valuation. Its stock performance has lagged behind the S&P 500 over the past year.

Read full news articleNo announcement available

Corporate Actions

No corporate action available