Key Events This Week

5 Jan: Mojo Grade downgraded to Sell amid technical weakness

6 Jan: Technical momentum shifts to mildly bearish; stock closes at Rs.438.30 (-1.96%)

8 Jan: Death Cross formation signals potential bearish trend

9 Jan: Intensified downtrend confirmed; stock closes at Rs.419.60 (-2.86%)

Max Estates Ltd Faces Intensified Downtrend Amid Bearish Technical Signals

2026-01-09 08:09:35Max Estates Ltd has experienced a notable shift in price momentum, with technical indicators signalling a bearish trend across multiple timeframes. The stock’s recent performance contrasts sharply with broader market benchmarks, underscoring challenges in the realty sector as investors reassess risk amid weakening technical signals.

Read full news articleWhy is Max Estates Ltd falling/rising?

2026-01-09 02:49:29

Recent Price Movement and Market Comparison

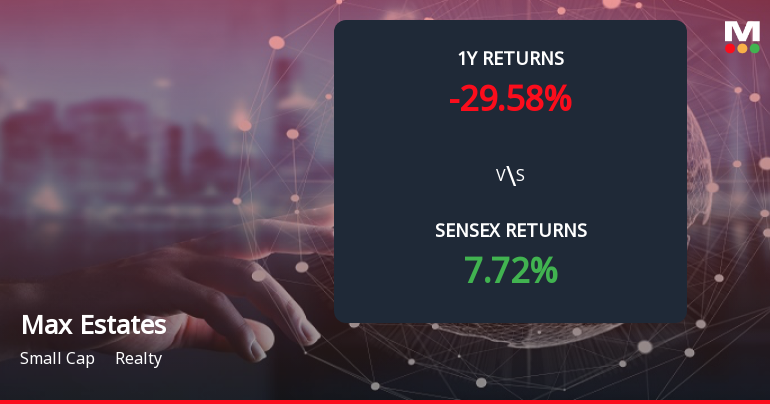

Max Estates has experienced a sustained downward trajectory over multiple time frames. In the past week, the stock fell by 6.16%, significantly underperforming the Sensex’s modest 1.18% decline. Over the last month, the stock dropped 3.78%, again lagging behind the Sensex’s 1.08% fall. Year-to-date, Max Estates has declined by 4.45%, compared to the Sensex’s 1.22% decrease. Most strikingly, over the past year, the stock has plummeted by 29.58%, while the Sensex has gained 7.72%. This stark contrast highlights the stock’s persistent weakness amid a generally positive market environment.

On the day of 08-Jan, the stock underperformed its sector by 1.05%, touching an intraday low of Rs 430.10. The weighted average price indicate...

Read full news article

Max Estates Ltd Forms Death Cross, Signalling Potential Bearish Trend

2026-01-08 18:02:53Max Estates Ltd has recently formed a Death Cross, a significant technical indicator where the 50-day moving average crosses below the 200-day moving average. This development signals a potential shift towards a bearish trend, reflecting deteriorating momentum and long-term weakness in the stock’s price action.

Read full news article

Max Estates Ltd Downgraded to Sell Amid Technical Weakness and Valuation Concerns

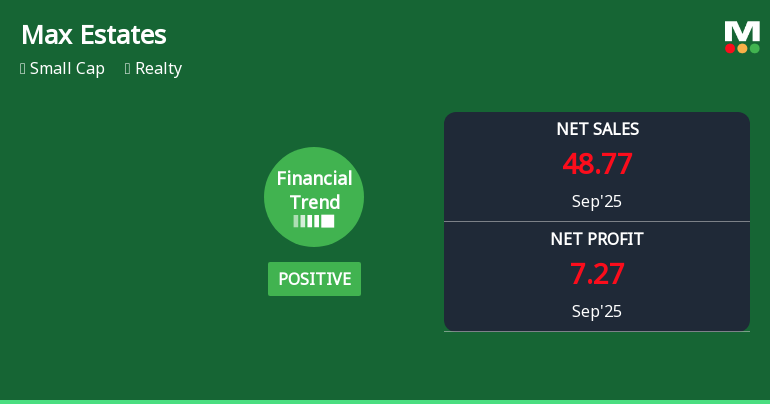

2026-01-06 09:04:45Max Estates Ltd, a player in the realty sector, has seen its investment rating downgraded from Hold to Sell as of 5 January 2026. This shift reflects a deterioration in technical indicators, valuation concerns, and financial trend challenges despite some positive operational performance. The company’s current Mojo Score stands at 41.0, with a Sell grade, signalling caution for investors amid mixed fundamentals and subdued price momentum.

Read full news article

Max Estates Ltd Faces Technical Momentum Shift Amid Bearish Signals

2026-01-06 08:39:55Max Estates Ltd, a key player in the realty sector, has experienced a notable shift in its technical momentum, moving from a mildly bullish to a mildly bearish trend. This change is underscored by a combination of bearish signals from key technical indicators such as MACD and Bollinger Bands, alongside a cautious stance from moving averages and other momentum oscillators. Investors should carefully analyse these developments in the context of the company’s recent price action and broader market trends.

Read full news article

Max Estates Ltd is Rated Hold by MarketsMOJO

2025-12-28 10:10:03Max Estates Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 25 Nov 2025. While the rating was revised on that date, the analysis below reflects the stock’s current position as of 28 December 2025, incorporating the latest fundamentals, returns, and financial metrics available today.

Read full news article

Max Estates Sees Revision in Market Evaluation Amid Mixed Financial Signals

2025-12-17 10:10:06Max Estates, a small-cap player in the realty sector, has experienced a revision in its market evaluation reflecting a nuanced shift in its financial and technical outlook. Despite recent declines in share price, the company’s operational performance and valuation metrics have prompted a reassessment of its standing within the sector.

Read full news article

Max Estates Quarterly Financial Performance Signals Shift Amid Market Challenges

2025-12-01 14:00:10Max Estates, a key player in the Indian realty sector, has exhibited a notable shift in its recent quarterly financial performance, reflecting a positive trend after a period of stagnation. The company’s latest results reveal a complex interplay of revenue growth, profit fluctuations, and balance sheet considerations, set against a broader market context that includes mixed returns relative to the Sensex benchmark.

Read full news article