Recent Price Movement and Market Context

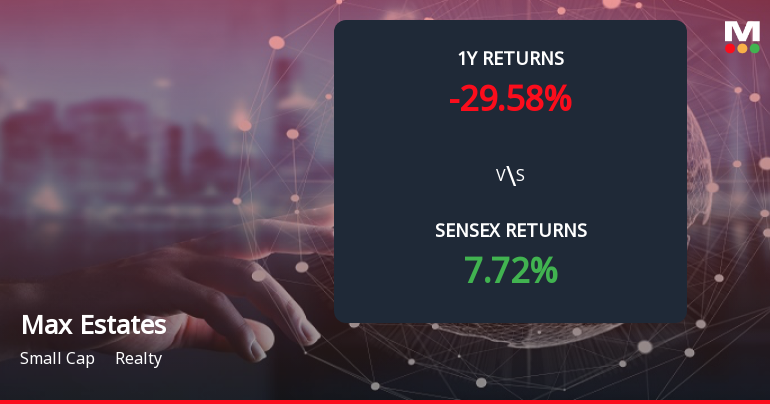

Max Estates has experienced a sustained fall in its stock price, losing 8.43% over the past week and 14.64% in the last month. Year-to-date, the stock has declined by 14.13%, significantly underperforming the Sensex, which has fallen by just 3.57% in the same period. Over the last year, the stock’s performance has been particularly weak, with a steep 34.31% loss, contrasting sharply with the Sensex’s 6.63% gain. This underperformance extends to longer-term horizons, where the stock has lagged behind the broader market indices.

On the day in question, despite the broader construction and real estate sector falling by 4.72%, Max Estates marginally outperformed its sector peers by 1.56%. However, the stock still touched an intraday...

Read full news article