Recent Price Momentum and Market Performance

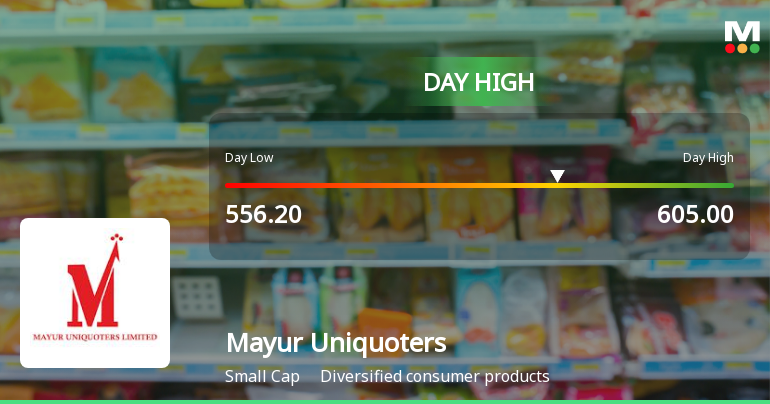

Mayur Uniquoters has demonstrated impressive price momentum in recent trading sessions. The stock has gained consistently over the last three days, delivering a cumulative return of 5.66% during this period. On 02-Feb, it opened with a gap up of 2.55%, signalling strong buying interest from the outset. Intraday, the share price touched a high of ₹539.05, maintaining a 2.55% gain. This performance is in line with the sector's movement, indicating that the stock is benefiting from broader positive sentiment within its industry segment.

Technically, the stock is trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, a clear indication of sustained bullish momentum. Such positioning often attracts momentu...

Read full news article