Recent Price Movement and Market Context

Mercantile Ventures has been on a downward trajectory over the past week, with the stock falling by 6.10%, in stark contrast to the Sensex which remained virtually flat, gaining a marginal 0.01%. This divergence highlights the stock’s relative weakness amid a broadly stable market environment. Over the last month, the decline has been even more pronounced, with the stock shedding 23.15% of its value while the Sensex advanced by 2.70%. Such a steep monthly fall indicates significant selling pressure and a lack of positive catalysts supporting the share price.

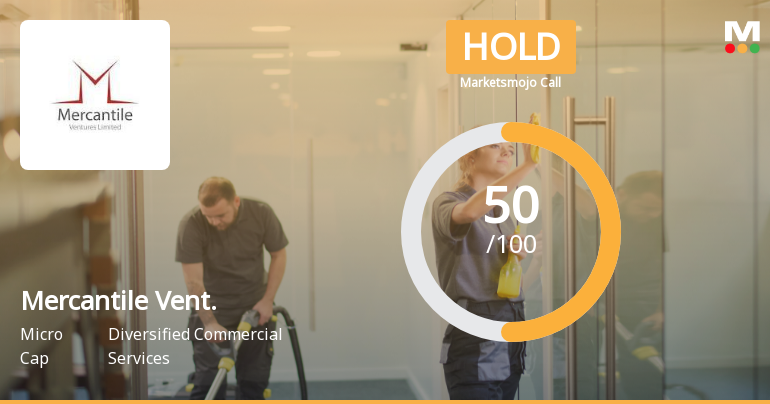

Year-to-date, Mercantile Ventures has marginally declined by 0.91%, whereas the Sensex has delivered a robust 9.69% gain. This underperformance over the year suggests that t...

Read More