Key Events This Week

Feb 9: Stock opens at Rs.118.00, up 1.46%

Feb 11: Q2 FY26 results reveal profit surge amid revenue stagnation

Feb 12: Positive financial trend reported despite mixed market returns

Feb 13: Week closes at Rs.121.95, down 1.89% on the day but up for the week

Are Metroglobal Ltd. latest results good or bad?

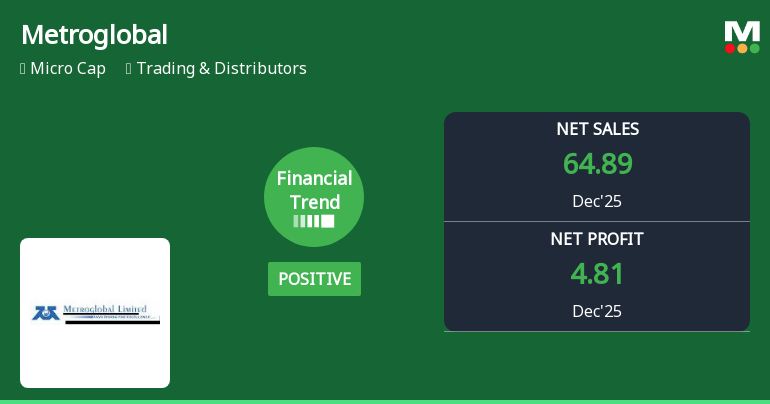

2026-02-12 19:56:56Metroglobal Ltd. has reported its latest financial results for the quarter ending December 2025, revealing a complex operational landscape. The company experienced a notable increase in net sales, achieving a year-on-year growth of 14.26%, which contrasts sharply with the previous year's decline of 16.78%. This improvement indicates a recovery in revenue generation, although it follows a period of significant volatility. In terms of profitability, Metroglobal's consolidated net profit saw a substantial year-on-year growth of 120.64%, compared to a decline of 45.64% in the same quarter last year. This dramatic turnaround suggests that the company has effectively managed to enhance its profitability, albeit the previous year's performance was notably weak. The operating profit margin, excluding other income, was reported at 7.58%, reflecting a slight increase from the previous period. This indicates some le...

Read full news article

Metroglobal Ltd. Reports Positive Financial Trend Amid Mixed Market Returns

2026-02-12 08:00:34Metroglobal Ltd., a player in the Trading & Distributors sector, has demonstrated a notable turnaround in its recent quarterly financial performance, shifting from a flat to a positive financial trend. Despite this improvement, the stock continues to face challenges in market returns relative to the broader Sensex index, reflecting a complex investment landscape for shareholders.

Read full news articleAre Metroglobal Ltd. latest results good or bad?

2026-02-11 19:47:51Metroglobal Ltd.'s latest financial results for Q2 FY26 reveal a complex operational landscape. The company reported consolidated net sales of ₹69.39 crores, reflecting a year-on-year growth of 0.36%, which is significantly lower than the previous year's growth rate of 12.86%. This indicates a stagnation in the core trading business, despite a sequential increase of 7.37% from the prior quarter. The consolidated net profit for the same quarter stood at ₹5.15 crores, marking a year-on-year increase of 30.38%, although this is a decline from the previous year's growth of 79.55%. Notably, over half of the profit before tax was derived from other income, raising concerns about the sustainability and quality of earnings generated from core operations. The operating margin, excluding other income, was reported at 6.08%, which shows an improvement from 4.04% in the year-ago quarter. However, this margin remains ...

Read full news article

Metroglobal Ltd. Q2 FY26: Profit Surge Masks Worrying Revenue Stagnation

2026-02-11 18:34:56Metroglobal Limited, a Mumbai-based commodity trading enterprise with a market capitalisation of ₹142.00 crores, reported a consolidated net profit of ₹5.15 crores for Q2 FY26, marking a robust 30.38% year-on-year growth. However, the headline numbers conceal a more complex reality: revenue growth has virtually stalled at 0.36% YoY, and the company's profitability remains heavily dependent on non-operating income, which constituted 54.36% of profit before tax during the quarter. The stock has underperformed significantly, declining 14.92% over the past year against the Sensex's 10.41% gain, and currently trades at ₹118.00, approximately 22.37% below its 52-week high of ₹152.00.

Read full news article

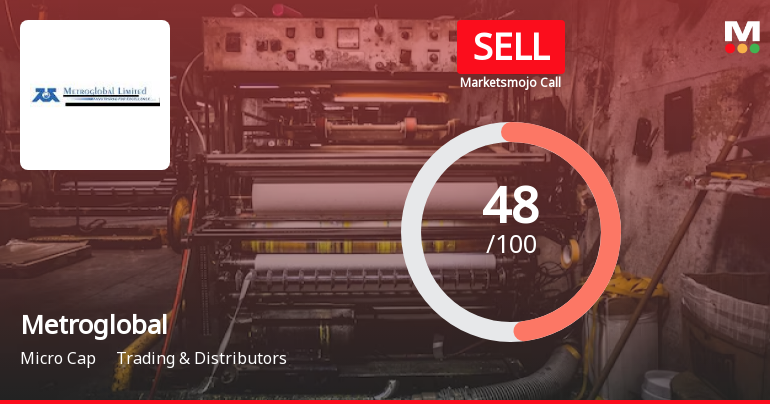

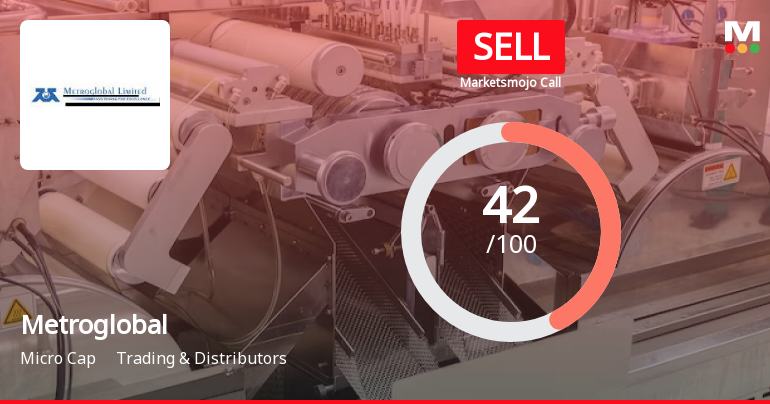

Metroglobal Ltd. is Rated Sell

2026-02-08 10:10:17Metroglobal Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 15 Nov 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 08 February 2026, providing investors with an up-to-date view of the stock’s fundamentals, returns, and technical outlook.

Read full news article