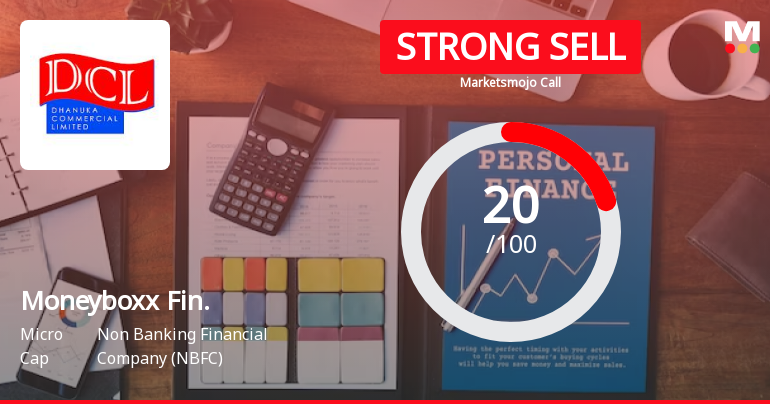

Recent Price Movements and Market Performance

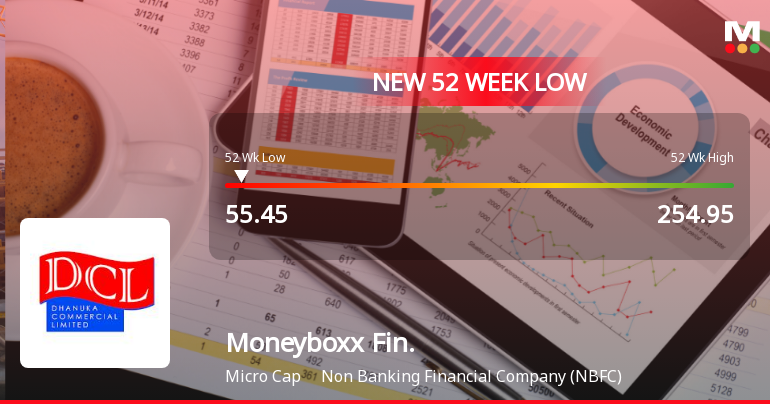

Moneyboxx Finance Ltd’s shares have been under pressure in recent sessions, with the stock recording a consecutive two-day fall resulting in a cumulative loss of 6.64%. On 19-Jan, the stock opened sharply lower, experiencing a gap down of 10.51%, signalling immediate bearish sentiment among investors. Intraday, the share price fluctuated widely between a high of ₹65 and a low of ₹55, a range of ₹10, underscoring significant volatility. Despite touching an intraday high that represented a 5.76% gain from the previous close, the stock ultimately settled near its low point, indicating selling pressure prevailed as the trading day progressed.

Technical Indicators and Trading Patterns

The weighted average...

Read full news article