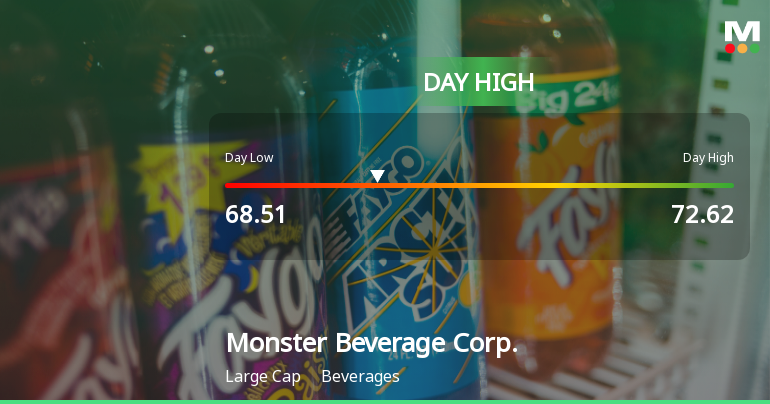

Monster Beverage Corp. Hits Day High with 5.16% Surge in Stock Price

2025-11-10 17:48:34Monster Beverage Corp. has seen a significant rise in stock performance, reaching an intraday high and outperforming the S&P 500 over the past year. The company demonstrates strong management efficiency with a high return on equity and low debt-to-equity ratio, alongside substantial operating cash flow and notable institutional holdings.

Read full news article

Monster Beverage Corp. Hits New 52-Week High of $72.62

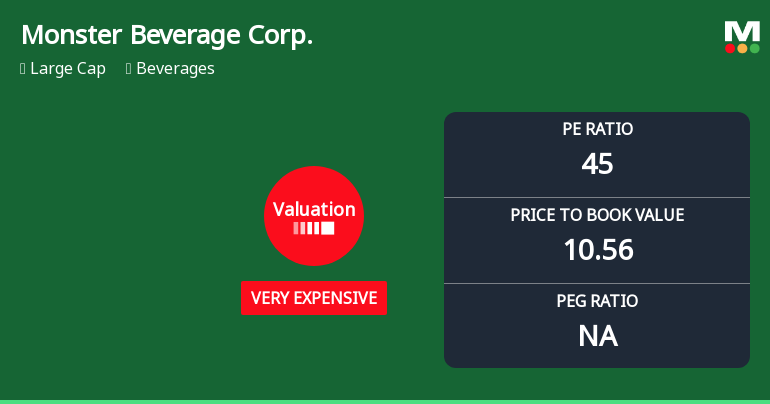

2025-11-10 17:14:22Monster Beverage Corp. achieved a new 52-week high of USD 72.62 on November 7, 2025, reflecting strong performance in the beverage sector. With a market capitalization of USD 68,512 million, the company shows robust financial metrics, including a P/E ratio of 45.00 and a return on equity of 23.21%.

Read full news article

Monster Beverage Corp. Experiences Revision in Its Stock Evaluation Amid Strong Performance

2025-11-10 15:49:52Monster Beverage Corp. has recently adjusted its valuation, with its current price at $69.73, up from $66.31. Over the past year, the company has achieved a 27.41% return, outperforming the S&P 500. Key metrics include a P/E ratio of 45 and a ROCE of 40.50%, indicating a strong market position.

Read full news article