Key Events This Week

Feb 9: Stock surged 7.61% to Rs.2,776.30 on strong volume

Feb 12: Q3 FY26 results revealed sharp quarterly loss despite revenue growth

Feb 13: Flat quarterly performance reported amid margin contraction; stock closed lower

Feb 13: Week ended with stock at Rs.2,527.60, down 2.03% for the week

Why is Naga Dhunseri Group Ltd falling/rising?

2026-02-14 01:13:06

Recent Price Movement and Market Context

The stock’s decline on 13-Feb is part of a broader downward trend observed over multiple time frames. Over the past week, Naga Dhunseri’s shares have fallen by 2.03%, nearly double the Sensex’s modest 0.87% decline. The one-month performance is even more pronounced, with the stock shedding 9.73%, compared to the Sensex’s 1.02% loss. Year-to-date, the stock has declined by 11.74%, significantly underperforming the benchmark’s 2.52% fall. This persistent underperformance highlights investor caution and a lack of positive catalysts driving the stock higher.

Over the longer term, the stock’s trajectory remains mixed. While it has delivered impressive gains of 83.33% over three years and an exceptional 199.50% over five years, the re...

Read full news articleAre Naga Dhunseri Group Ltd latest results good or bad?

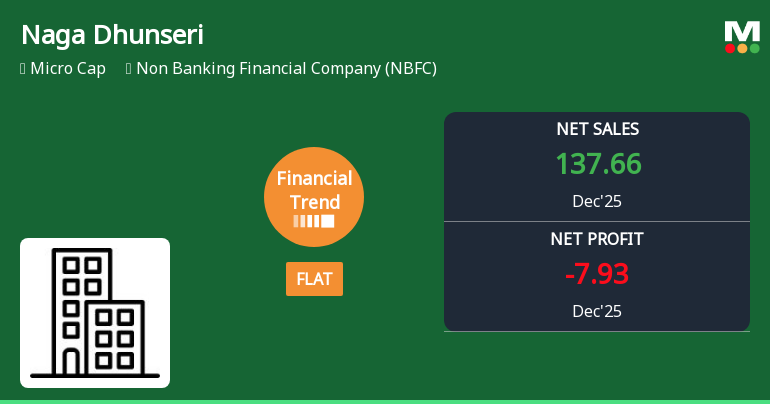

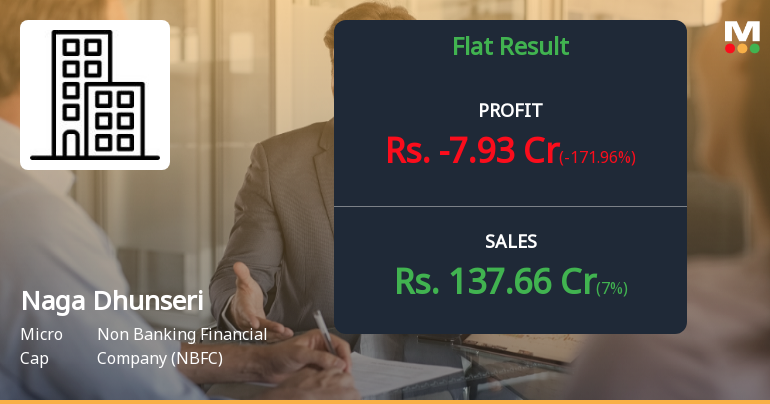

2026-02-13 20:00:59Naga Dhunseri Group Ltd's latest financial results for the quarter ending December 2025 present a complex picture characterized by significant revenue growth alongside substantial profitability challenges. The company reported net sales of ₹137.66 crores, reflecting an extraordinary year-on-year increase of 7,032.64%, which indicates a strong expansion in revenue generation capabilities. However, this growth has not translated into profitability, as the company recorded a net loss of ₹7.93 crores, marking a year-on-year decline of 171.96%. The operational performance reveals critical issues, particularly with the operating profit margin, which fell to negative 4.31% from a previous robust level of 76.17%. This sharp decline illustrates severe operational inefficiencies and challenges in managing costs, particularly employee expenses, which surged dramatically to ₹58.03 crores, consuming a significant porti...

Read full news article

Naga Dhunseri Group Ltd Reports Flat Quarterly Performance Amid Margin Pressures

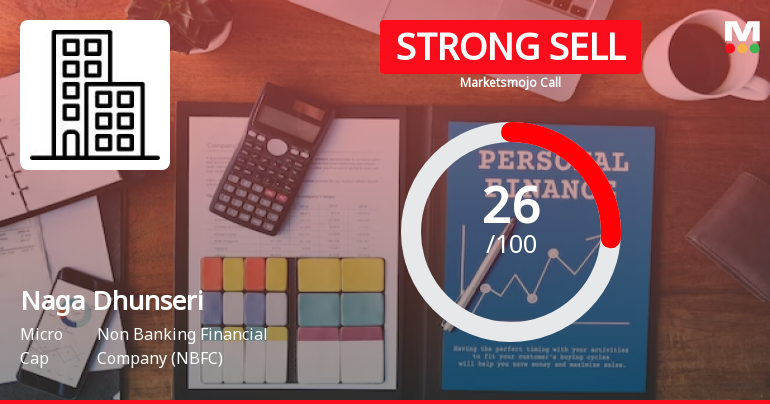

2026-02-13 08:00:39Naga Dhunseri Group Ltd, a key player in the Non Banking Financial Company (NBFC) sector, has reported a flat financial performance for the quarter ended December 2025, signalling a notable shift from its previously positive growth trajectory. Despite higher net sales, the company faced significant margin contraction and losses, prompting a downgrade in its Mojo Grade to Strong Sell.

Read full news article

Naga Dhunseri Group Q3 FY26: Sharp Quarterly Loss Raises Concerns Despite Strong Revenue Base

2026-02-12 17:34:14Naga Dhunseri Group Ltd., a micro-cap non-banking financial company with a market capitalisation of ₹265.00 crores, has reported a consolidated net loss of ₹7.93 crores for Q3 FY26 (October-December 2025), marking a dramatic reversal from the ₹11.02 crores profit in the corresponding quarter last year. The company's stock has declined 2.36% following the results, trading at ₹2,598.70, and has plunged 44.54% from its 52-week high of ₹4,685.40.

Read full news article

Naga Dhunseri Group Ltd is Rated Sell

2026-02-06 10:11:09Naga Dhunseri Group Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 22 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 06 February 2026, providing investors with an up-to-date perspective on the company’s standing.

Read full news article

Naga Dhunseri Group Ltd is Rated Sell

2026-01-26 10:10:42Naga Dhunseri Group Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 22 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 26 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article