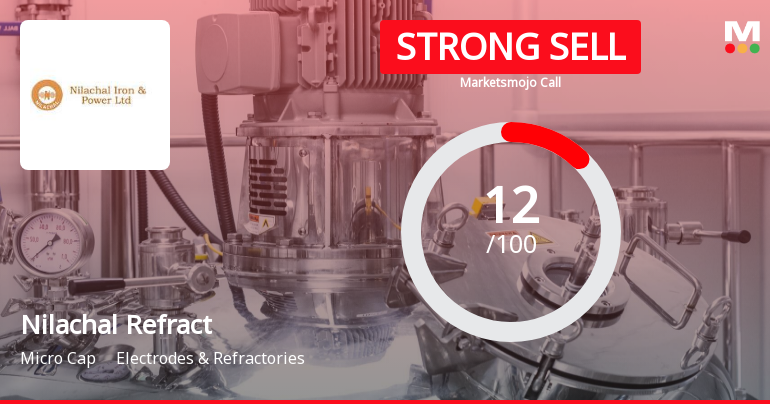

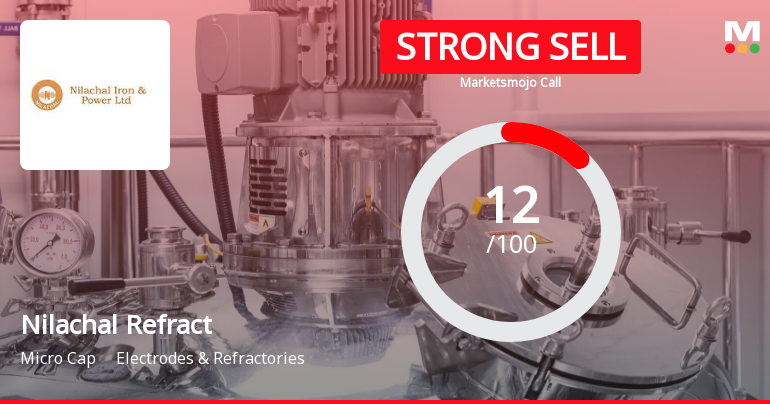

Nilachal Refractories Ltd is Rated Strong Sell

2026-03-04 10:10:18Nilachal Refractories Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 27 Feb 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 04 March 2026, providing investors with an up-to-date view of the stock’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article

Nilachal Refractories Ltd is Rated Strong Sell

2026-02-21 10:10:18Nilachal Refractories Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 27 February 2025. However, the analysis and financial metrics discussed below reflect the stock’s current position as of 21 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Nilachal Refractories Ltd is Rated Strong Sell

2026-02-10 10:10:25Nilachal Refractories Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 27 February 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 10 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article

Nilachal Refractories Ltd is Rated Strong Sell

2026-01-30 10:10:35Nilachal Refractories Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 27 February 2025, reflecting a significant reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed below are current as of 30 January 2026, providing investors with an up-to-date view of the company’s position.

Read full news article

Nilachal Refractories Ltd Falls to 52-Week Low Amidst Continued Downtrend

2026-01-27 15:44:24Nilachal Refractories Ltd, a player in the Electrodes & Refractories sector, recorded a new 52-week low of Rs.28.88 today, marking a significant milestone in its recent price trajectory amid a volatile trading session.

Read full news articleAre Nilachal Refractories Ltd latest results good or bad?

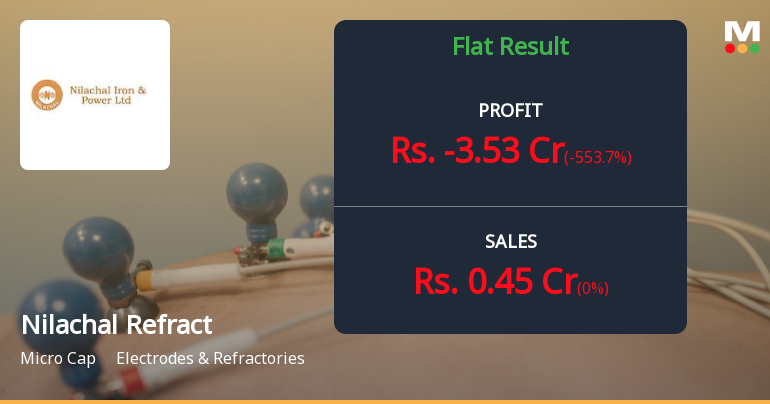

2026-01-25 19:11:23Nilachal Refractories Ltd's latest financial results for Q3 FY26 reveal significant challenges facing the company. The reported net profit was a loss of ₹3.53 crores, marking a substantial decline compared to the previous year. Although revenue remained stable at ₹0.45 crores, this represents a year-on-year increase of 55.17%, indicating some growth in sales despite the overall financial distress. The operating margin for the quarter was notably negative at 795.56%, which highlights severe operational inefficiencies, as the company is losing significantly more than it earns from its operations. This is a marked deterioration from the previous quarter's negative margin, suggesting a worsening financial situation. The company's book value is also concerning, with a negative equity position of ₹27.94 crores, indicating that its liabilities exceed its assets. Additionally, the company's return on capital empl...

Read full news article

Nilachal Refractories Q3 FY26: Mounting Losses Signal Deepening Crisis

2026-01-24 21:31:02Nilachal Refractories Ltd., a micro-cap player in the electrodes and refractories sector, reported a catastrophic quarterly loss of ₹3.53 crores in Q3 FY26, marking a severe deterioration from the ₹0.54 crore loss in Q2 FY26 and a staggering 740.48% increase in losses compared to the ₹0.42 crore loss in Q3 FY25. With a market capitalisation of just ₹73.00 crores and trading at ₹33.95 per share, the Bhubaneswar-based company faces mounting operational challenges that have pushed it into negative book value territory at ₹-13.72 per share.

Read full news article

Nilachal Refractories Ltd Falls to 52-Week Low of Rs.32 Amidst Continued Underperformance

2026-01-22 10:43:46Nilachal Refractories Ltd has touched a fresh 52-week low of Rs.32 today, marking a significant decline in its stock price amid a backdrop of subdued financial performance and sector dynamics. This new low reflects ongoing challenges faced by the company within the Electrodes & Refractories industry, even as the broader market and sector indices show contrasting trends.

Read full news articleDisclosures under Reg. 10(5) in respect of acquisition under Reg. 10(1)(a) of SEBI (SAST) Regulations 2011

04-Mar-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 10(5) in respect of acquisition under Regulation 10(1)(a) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Bhagwati Prasad Jalan & Others

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

04-Mar-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Bhagwati Prasad Jalan & Others

OUTCOME OF THE BOARDE MEETING HELD ON 13/02/2026 UNDER REGULATIONS 30 OF SEBI ( LISTING OBLIGATIONS AND DISCLOSURES REQUIREMENT) REGULATIONS 2015

13-Feb-2026 | Source : BSECONSIDERED AND APPROVED THE CONSENT OF THE RELEVANT CLASS OF SHAREHOLDERS IN RESPECT OF THE VARIATION OF RIGHTS ATTACHED TO 0% REDEEMABLE PREFERENCE SHARES PURSUANT TO SECTION 48 OF THE COMPANIES ACT 2013.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available