Key Events This Week

27 Jan: Stock opens week at Rs.799.40, down 2.84%

28 Jan: Sharp rebound with 4.22% gain to Rs.833.10

29 Jan: Q3 FY26 results reveal strong revenue growth and profit volatility

30 Jan: Intraday high of Rs.894.75 with 5.22% surge; week closes at Rs.878.65 (+2.17%)

Nippon Life India Asset Management Ltd is Rated Hold

2026-01-31 10:10:33Nippon Life India Asset Management Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 30 October 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 31 January 2026, providing investors with an up-to-date perspective on the company's performance and outlook.

Read full news articleAre Nippon Life India Asset Management Ltd latest results good or bad?

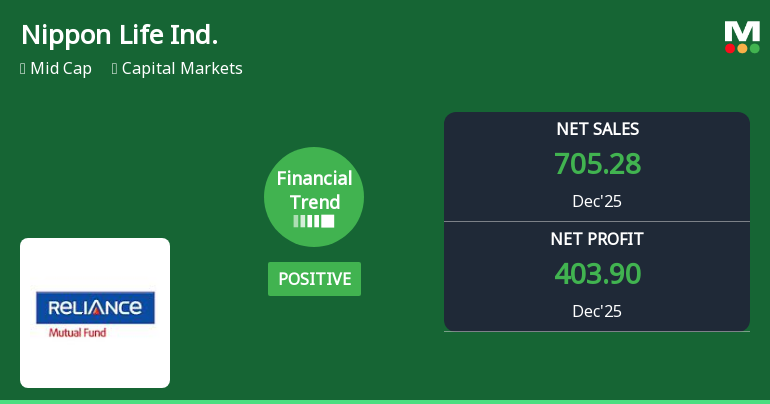

2026-01-30 19:27:42Nippon Life India Asset Management Ltd's latest financial results reveal a complex operational landscape. In the quarter ended December 2025, the company reported net sales of ₹705.28 crores, reflecting a year-on-year growth of 19.97%, albeit a decrease from the previous year's growth rate of 38.88%. This indicates a slowdown in revenue expansion compared to prior periods, although the absolute sales figure remains robust. On the profitability front, consolidated net profit reached ₹403.90 crores, marking a significant year-on-year increase of 36.75%, which is a notable improvement from the previous year's growth of just 3.90%. This suggests that while revenue growth has moderated, the company has managed to enhance its profitability effectively. The operating profit margin (excluding other income) slightly improved to 66.66%, up from 65.61% in the prior year, indicating that the company has maintained it...

Read full news article

Nippon Life India Asset Management Ltd Hits Intraday High with 5.22% Surge

2026-01-30 09:31:52Nippon Life India Asset Management Ltd demonstrated robust intraday performance on 30 Jan 2026, surging 5.22% to touch a day’s high of Rs 894.75. The stock outpaced its sector and broader market indices, continuing a three-day winning streak with notable volatility and sustained momentum across key moving averages.

Read full news article

Nippon Life India Asset Management Ltd Reports Strong Quarterly Financial Turnaround

2026-01-30 08:00:31Nippon Life India Asset Management Ltd has demonstrated a marked improvement in its financial performance for the quarter ended December 2025, signalling a positive shift from a previously flat trend. The company posted record quarterly figures across key metrics including net sales, operating profit, and earnings per share, reflecting robust operational execution and favourable market conditions within the capital markets sector.

Read full news article

Nippon Life India Asset Management Q3 FY26: Robust Revenue Growth Meets Profit Volatility Amid Premium Valuation

2026-01-29 19:03:21Nippon Life India Asset Management Ltd. (NAM India), one of India's largest asset management companies with ₹3.63 lakh crores in assets under management, delivered a mixed performance in Q2 FY26 (July-September 2025), posting a consolidated net profit of ₹344.64 crores—down 13.00% quarter-on-quarter but declining 4.29% year-on-year. The company's stock, trading at ₹860.00 with a market capitalisation of ₹53,449 crores, has rallied 50.42% over the past year, significantly outperforming the Sensex's 7.88% gain during the same period, though it currently trades 12.84% below its 52-week high of ₹986.70.

Read full news article

Nippon Life India Asset Management Ltd is Rated Hold

2026-01-20 10:10:24Nippon Life India Asset Management Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 30 October 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 20 January 2026, providing investors with an up-to-date view of its fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Nippon Life India Asset Management Ltd is Rated Hold

2026-01-09 10:10:25Nippon Life India Asset Management Ltd is rated 'Hold' by MarketsMOJO. This rating was last updated on 30 October 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 09 January 2026, providing investors with an up-to-date view of its fundamentals, returns, and market standing.

Read full news article

Nippon Life India Asset Management Ltd: Technical Momentum Shifts Signal Cautious Outlook

2026-01-02 08:13:51Nippon Life India Asset Management Ltd has experienced a subtle shift in its technical momentum, transitioning from a bullish to a mildly bullish trend as of early January 2026. Despite a modest decline in the stock price, the technical indicators present a nuanced picture, with some suggesting caution while others maintain a positive outlook. This article analyses the recent price momentum, key technical signals including MACD, RSI, moving averages, and places the stock’s performance in the context of broader market movements.

Read full news article