Key Events This Week

19 Jan: MarketsMOJO upgrades Nirlon Ltd to Hold on improved technicals and financials

19 Jan: Mixed technical signals emerge amid mild momentum shift

23 Jan: Stock closes the week lower at Rs.489.60 (-1.81% on the day)

Feb 09

BSE+NSE Vol: 3.89 k

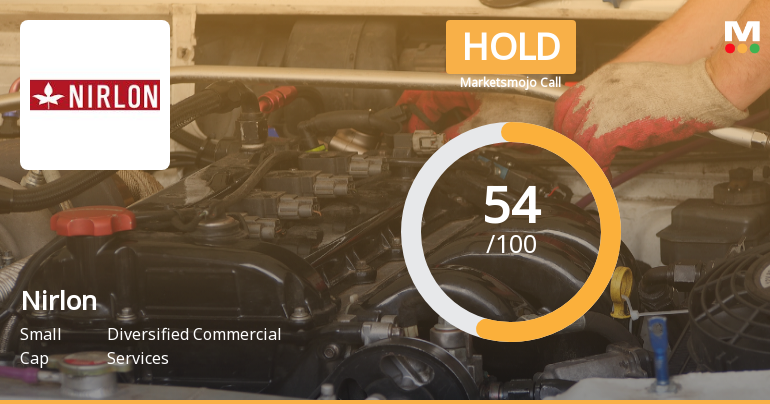

Nirlon Ltd has exhibited a nuanced shift in its technical momentum, transitioning from a mildly bearish stance to a sideways trend, reflecting a complex interplay of bullish and bearish signals across multiple timeframes. The company’s recent upgrade from a Sell to a Hold rating by MarketsMOJO on 16 January 2026 underscores this evolving outlook, as investors weigh mixed technical indicators alongside steady price performance within the diversified commercial services sector.

Read full news article

Nirlon Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 16 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 30 January 2026, providing investors with the most recent and relevant data to assess the company’s outlook.

Read full news article

19 Jan: MarketsMOJO upgrades Nirlon Ltd to Hold on improved technicals and financials

19 Jan: Mixed technical signals emerge amid mild momentum shift

23 Jan: Stock closes the week lower at Rs.489.60 (-1.81% on the day)

Nirlon Ltd, a key player in the Diversified Commercial Services sector, has seen its investment rating upgraded from Sell to Hold as of 16 January 2026. This shift reflects a nuanced improvement across multiple parameters including quality, valuation, financial trends, and technical indicators. Despite some lingering concerns, the company’s recent performance and market positioning warrant a more balanced outlook for investors.

Read full news article

Nirlon Ltd has exhibited a subtle but noteworthy shift in its technical momentum, moving from a bearish stance to a mildly bearish outlook as of mid-January 2026. This transition is underscored by a complex interplay of technical indicators including MACD, RSI, Bollinger Bands, and moving averages, signalling a nuanced market sentiment for this diversified commercial services stock.

Read full news article

Nirlon Ltd has experienced a subtle shift in its technical momentum, moving from a bearish stance to a mildly bearish outlook as of early January 2026. Despite a modest day gain of 0.63%, the stock’s technical indicators present a complex picture, with some signals suggesting caution while others hint at potential stabilisation. This analysis delves into the recent technical parameter changes, examining key momentum indicators such as MACD, RSI, moving averages, and broader trend assessments to provide investors with a comprehensive view of Nirlon’s current market positioning.

Read full news article

2025-12-29: Stock opens at Rs.498.30, down 1.10% amid broader market weakness

2025-12-30: Modest recovery to Rs.501.75 (+0.69%) despite Sensex decline

2025-12-31: Slight gain to Rs.502.45 (+0.14%) as Sensex rallies 0.83%

2026-01-01: Price dips to Rs.500.20 (-0.45%) on mixed technical signals

2026-01-02: Downgrade to Sell announced; stock closes at Rs.503.35 (+0.63%) amid bearish technical momentum

Nirlon Ltd, a key player in the diversified commercial services sector, has seen its investment rating downgraded from Hold to Sell as of 1 January 2026. This revision reflects a combination of deteriorating technical indicators, valuation pressures, and concerns over financial trends despite recent positive quarterly results. The company’s Mojo Score has declined to 48.0, signalling caution for investors amid a challenging market backdrop.

Read full news article

Nirlon Ltd, a key player in the Diversified Commercial Services sector, has experienced a notable shift in its technical momentum, with several indicators signalling a bearish trend. Despite a modest price decline and mixed signals from momentum oscillators, the stock’s recent downgrade from Hold to Sell by MarketsMOJO underscores growing caution among analysts and investors alike.

Read full news articleThe Company has published newspapers notice on February 4 2026 informing about the SEBI circular dated January 302026 on the special window for transfer and demat of physical securities

The Risk Management Committee of the Board of Directors will be held on Tuesday February 10 2026

UNDATE ABOUNT THE SEBI CIRCULAR DATED JANUARY 302026 - SPECIAL WINODOW FOR TRASNFER AND DEMAT OF PHYSICAL SECURITIES

10 Feb 2026

Nirlon Ltd has declared 110% dividend, ex-date: 11 Sep 25

No Splits history available

No Bonus history available

No Rights history available