Key Events This Week

16 Feb: Quality grade downgraded to below average, Strong Sell rating assigned

17 Feb: Valuation shifts to very expensive with P/E ratio surging to 114.89

19 Feb: Stock surges 5.51% amid market volatility

20 Feb: Week closes at Rs.199.57, up 9.02% for the week

Nitiraj Engineers Ltd is Rated Strong Sell

2026-02-19 10:10:26Nitiraj Engineers Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 16 February 2026. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 19 February 2026, providing investors with the most up-to-date perspective on the company’s performance and outlook.

Read full news article

Nitiraj Engineers Ltd Valuation Shifts to Very Expensive Amidst Mixed Market Performance

2026-02-17 08:04:01Nitiraj Engineers Ltd has witnessed a significant shift in its valuation parameters, moving from an attractive to a very expensive rating. With a price-to-earnings (P/E) ratio soaring to 114.89 and a price-to-book value (P/BV) of 2.24, the stock now trades at a premium well above its historical and peer averages. This article analyses the implications of these valuation changes, comparing Nitiraj’s metrics with industry peers and assessing the impact on investor sentiment and future prospects.

Read full news article

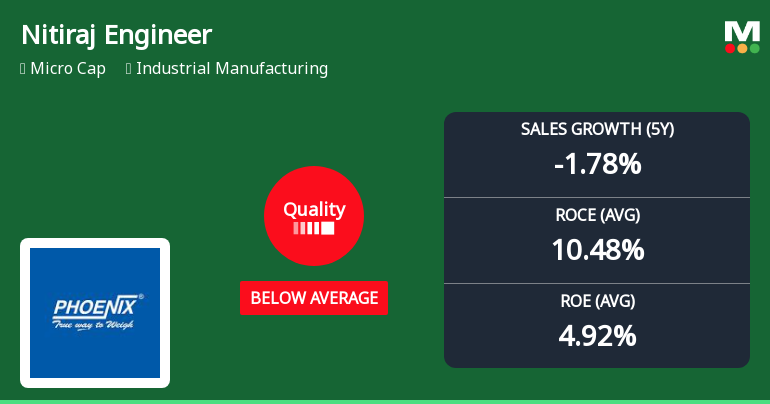

Nitiraj Engineers Ltd Quality Grade Downgrade Highlights Fundamental Challenges

2026-02-17 08:01:16Nitiraj Engineers Ltd, a player in the industrial manufacturing sector, has recently seen its quality grade downgraded from average to below average, prompting a thorough examination of its business fundamentals. Despite a strong long-term return profile, key metrics such as return on equity (ROE), return on capital employed (ROCE), and growth rates have deteriorated, raising concerns about the company’s operational efficiency and financial health.

Read full news articleAre Nitiraj Engineers Ltd latest results good or bad?

2026-02-13 20:20:05Nitiraj Engineers Ltd's latest financial results present a mixed picture. The company reported a significant year-on-year growth in net sales of 30.49% for the quarter ending September 2025, recovering from a previous decline of -21.06% in the same quarter of the prior year. This growth in sales indicates a positive momentum in revenue generation, suggesting an improvement in market demand and operational performance. However, despite this revenue growth, the profitability metrics raise concerns. The standalone net profit showed an extraordinary growth of 8,050% compared to a significant loss in the previous year, indicating a recovery in profitability. Nevertheless, the operating profit margin, while improved, stood at 16.60%, which is lower than the previous year's margin of 16.60%, reflecting ongoing challenges in maintaining consistent profitability levels. The company's return on equity remains notab...

Read full news article

Nitiraj Engineers Ltd is Rated Sell by MarketsMOJO

2026-02-08 10:10:17Nitiraj Engineers Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 17 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 08 February 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

Nitiraj Engineers Ltd is Rated Sell

2026-01-28 10:10:20Nitiraj Engineers Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 17 Nov 2025. While the rating was revised on that date, the analysis and financial metrics discussed here reflect the stock's current position as of 28 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market standing.

Read full news article

Nitiraj Engineers Ltd is Rated Sell

2026-01-05 10:13:31Nitiraj Engineers Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 17 Nov 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 05 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market standing.

Read full news article