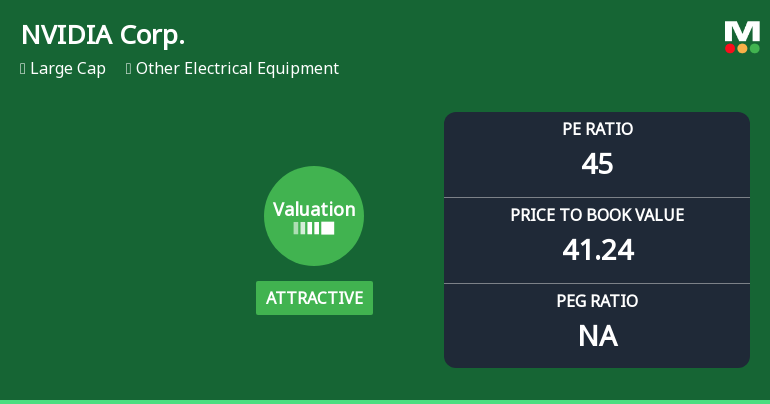

NVIDIA Corp. Experiences Valuation Adjustment Amid Strong Market Performance and Metrics

2025-11-10 15:53:23NVIDIA Corp. has recently adjusted its valuation, with its stock price at $188.15. Over the past year, it achieved a 26.38% return, outperforming the S&P 500. Key metrics include a P/E ratio of 45, a ROCE of 221.46%, and a ROE of 90.70%, showcasing its strong profitability and competitive position in the industry.

Read full news articleNo announcement available

Corporate Actions

No corporate action available