Okeanis Eco Tankers Hits Day High with 8.76% Surge in Stock Price

2025-11-14 16:24:08Okeanis Eco Tankers Corp. has seen a notable rise in stock performance, achieving an intraday high and significant gains over the past month and year-to-date. Despite challenges in long-term growth, the company's current metrics reflect a strong short-term rebound within the transport services industry.

Read full news article

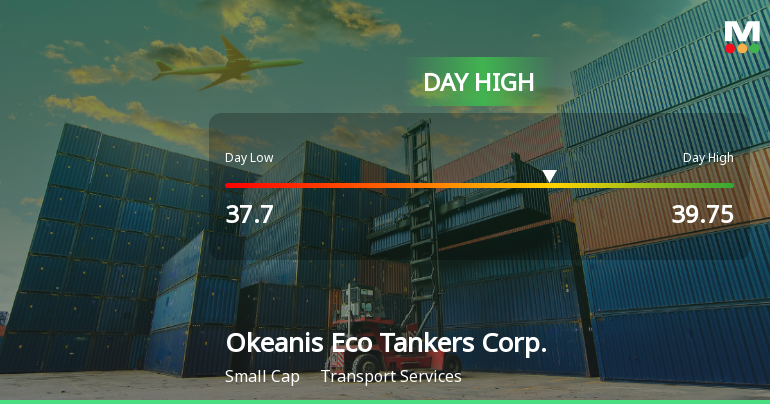

Okeanis Eco Tankers Corp. Hits New 52-Week High at $39.75

2025-11-14 16:00:22Okeanis Eco Tankers Corp. achieved a new 52-week high of USD 39.75 on November 13, 2025, reflecting its strong performance in the transport services industry. The company has recorded a 16.07% increase over the past year, with solid financial metrics and a commitment to shareholder value.

Read full news article

Okeanis Eco Tankers Corp. Hits New 52-Week High at $35.92

2025-11-13 16:09:53Okeanis Eco Tankers Corp. has achieved a new 52-week high of USD 35.92, significantly up from its low of USD 17.91. The company, with a market cap of USD 921 million, features a P/E ratio of 9.00, a dividend yield of 6.50%, and a return on equity of 15.34%.

Read full news article