Ollie's Bargain Outlet Experiences Revision in Stock Evaluation Amid Market Dynamics

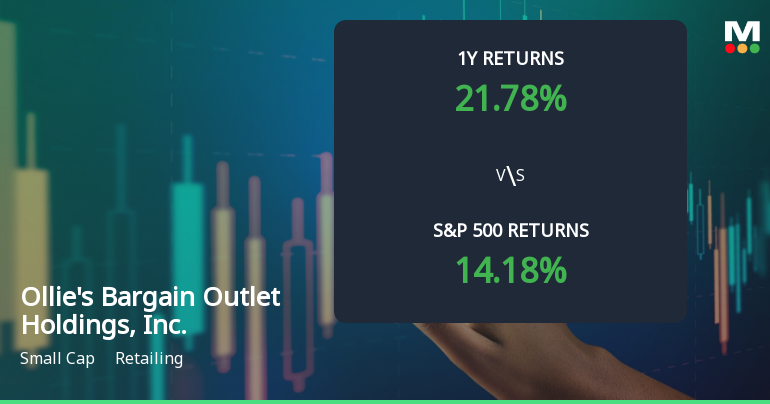

2025-12-01 16:04:52Ollie's Bargain Outlet Holdings, Inc. has recently revised its evaluation amid fluctuating stock prices, currently at $123.11. The company has shown resilience, outperforming the S&P 500 over various timeframes, including a year-to-date return of 12.19% and a remarkable three-year return of 97.86%.

Read full news articleNo announcement available

Corporate Actions

No corporate action available