Om Infra Ltd Stock Falls to 52-Week Low of Rs.71.72 Amid Continued Downtrend

2026-01-28 09:54:25Om Infra Ltd’s share price declined to a fresh 52-week low of Rs.71.72 today, marking a significant milestone in the stock’s ongoing downward trajectory. Despite a slight intraday recovery, the stock remains under pressure, reflecting persistent challenges in the company’s financial performance and market positioning.

Read full news article

Om Infra Ltd Stock Hits 52-Week Low at Rs.71.72 Amid Continued Downtrend

2026-01-28 09:54:21Om Infra Ltd’s stock touched a fresh 52-week low of Rs.71.72 today, marking a significant decline amid persistent negative financial performance and subdued market sentiment within the construction sector.

Read full news article

Om Infra Ltd Stock Falls to 52-Week Low of Rs.73.01 Amid Continued Downtrend

2026-01-27 10:27:06Shares of Om Infra Ltd, a player in the construction sector, declined sharply to a fresh 52-week low of Rs.73.01 on 27 Jan 2026, marking a significant milestone in the stock’s ongoing downward trajectory. This new low reflects persistent headwinds faced by the company, with the stock underperforming its sector and broader market indices over the past year.

Read full news article

Om Infra Ltd Stock Falls to 52-Week Low of Rs.75 Amid Continued Downtrend

2026-01-23 13:39:59Om Infra Ltd, a player in the construction sector, witnessed its stock price decline to a fresh 52-week low of Rs.75 today, marking a significant downturn amid broader market weakness and company-specific performance issues.

Read full news article

Om Infra Ltd is Rated Strong Sell

2026-01-23 10:10:29Om Infra Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 04 Aug 2025. However, the analysis and financial metrics discussed below reflect the stock’s current position as of 23 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

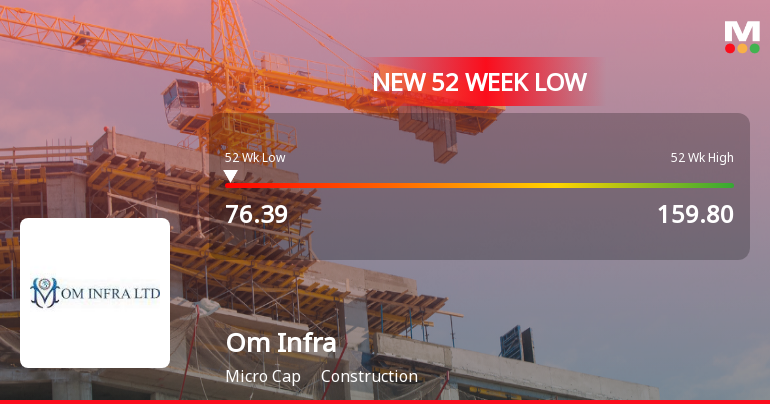

Om Infra Ltd Falls to 52-Week Low Amid Continued Financial Struggles

2026-01-21 12:17:05Shares of Om Infra Ltd, a player in the construction sector, declined to a fresh 52-week low of Rs.76.39 today, marking a significant milestone in the stock’s ongoing downward trajectory. This new low reflects persistent pressures on the company’s financial performance and market valuation over the past year.

Read full news article

Om Infra Ltd Stock Falls to 52-Week Low of Rs.77.6 Amid Continued Weak Performance

2026-01-20 14:16:44Om Infra Ltd’s shares declined sharply to a fresh 52-week low of Rs.77.6 on 20 Jan 2026, marking a significant milestone in the stock’s ongoing downward trajectory. The stock underperformed its sector and broader market indices, reflecting persistent financial headwinds and subdued performance metrics.

Read full news article

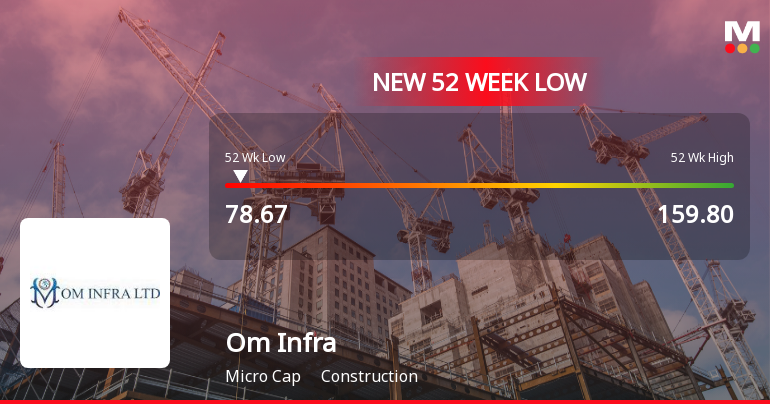

Om Infra Ltd Falls to 52-Week Low Amid Continued Downtrend

2026-01-12 12:47:28Shares of Om Infra Ltd, a player in the construction sector, declined sharply to a fresh 52-week low of Rs.78.67 on 12 Jan 2026, marking a significant milestone in the stock’s ongoing downward trajectory. This new low reflects a sustained period of underperformance relative to the broader market and sector peers.

Read full news article

Om Infra Ltd is Rated Strong Sell

2026-01-12 10:10:21Om Infra Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 04 Aug 2025, reflecting a significant reassessment of the stock’s outlook. However, the analysis and financial metrics discussed below are based on the company’s current position as of 12 January 2026, providing investors with the latest insights into its performance and prospects.

Read full news articleBoard Meeting Intimation for INTIMATION OF BOARD MEETING

29-Jan-2026 | Source : BSEOM Infra Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 06/02/2026 inter alia to consider and approve Pursuant to Regulation 29 of the Securities and Exchange Board of India (Listing Obligation and Disclosure Requirements) Regulation 2015 the Notice is hereby given that a meeting of Board of Directors of the Company is scheduled to be held on 6th February 2026 inter alia to consider and approve unaudited financial results (Standalone & Consolidated) along with Limited Review Report for the quarter ended 31st December 2026.

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

24-Jan-2026 | Source : BSEOm Infra Limited hereby informs about the development on the Contracts awarded to the Company by NHPC Limited for the Dibang Multipurpose Projects.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

13-Jan-2026 | Source : BSEOm Infra hereby submit a certificate under Regulation 74(5) of SEBI (Depositories and Participates ) Regulations 2018 for the quarter ended 31st December 2025

Corporate Actions

06 Feb 2026

Om Infra Ltd has declared 40% dividend, ex-date: 22 Sep 25

No Splits history available

No Bonus history available

No Rights history available