Key Events This Week

27 Jan 2026: Q3 FY26 results reveal margin recovery, stock surges 6.46%

29 Jan 2026: Valuation shifts to fair amid mixed returns, stock declines 2.99%

30 Jan 2026: Stock closes flat at Rs.270.95, Sensex dips 0.22%

Mar 09

BSE+NSE Vol: 44.63 k

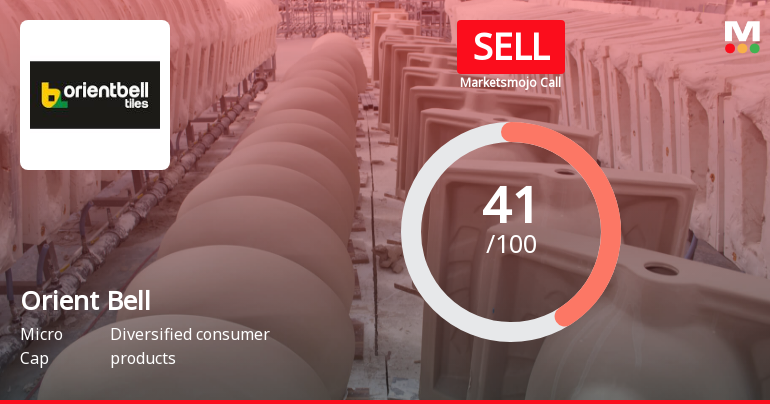

Orient Bell Ltd., a key player in the diversified consumer products sector, has seen its investment rating downgraded from Hold to Sell as of 6 March 2026. This revision reflects a combination of deteriorating technical indicators, expensive valuation metrics, and subdued financial trends despite some positive quarterly results. The company’s current Mojo Score stands at 42.0, classified as Sell, marking a significant shift from its previous Hold status.

Read full news article

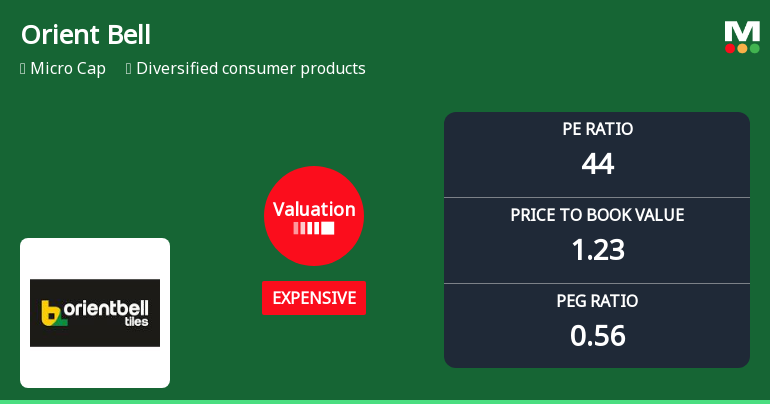

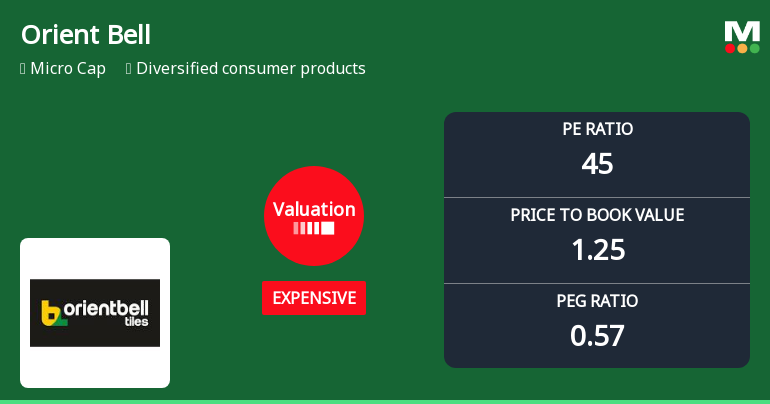

Orient Bell Ltd., a key player in the diversified consumer products sector, has experienced a notable shift in its valuation parameters, prompting a downgrade in its investment grade. The company’s price-to-earnings (P/E) ratio and price-to-book value (P/BV) have moved from very expensive to merely expensive territory, signalling a change in price attractiveness amid broader market pressures and sector dynamics.

Read full news article

Orient Bell Ltd., a key player in the diversified consumer products sector, has seen its investment rating upgraded from Sell to Hold, reflecting a notable improvement in its technical indicators, financial trends, valuation metrics, and overall quality assessment. This upgrade, effective from 2 March 2026, comes amid a backdrop of positive quarterly results and a shift in market sentiment, signalling cautious optimism among investors.

Read full news article

Orient Bell Ltd., a key player in the diversified consumer products sector, has seen its investment rating downgraded from Hold to Sell as of 24 February 2026. This shift reflects a nuanced reassessment across four critical parameters: quality, valuation, financial trend, and technicals. Despite positive quarterly financial results and healthy long-term growth, the stock’s technical indicators and valuation metrics have raised caution among analysts, prompting a more conservative stance.

Read full news article

Orient Bell Ltd., a key player in the diversified consumer products sector, has seen its investment rating upgraded from Sell to Hold as of 19 Feb 2026. This change reflects a combination of improved technical indicators, solid financial trends, and a reassessment of valuation metrics, signalling a cautious but optimistic outlook for investors.

Read full news article

Orient Bell Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 08 January 2026. However, the analysis and financial metrics discussed below reflect the stock's current position as of 13 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Orient Bell Ltd., a key player in the diversified consumer products sector, has seen a notable shift in its valuation parameters, moving from fair to expensive territory. This change, reflected in its elevated price-to-earnings (P/E) and price-to-book value (P/BV) ratios, raises questions about the stock’s price attractiveness relative to its historical averages and peer group, amid a challenging market backdrop.

Read full news article

Orient Bell Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 08 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 02 February 2026, providing investors with the most up-to-date view of the company’s performance and outlook.

Read full news articleThis is with reference to Regulation 30(6) of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 read with Para A of Part A of Schedule III of the said Regulations. In this regard we wish to inform you that company officials will be having virtual meeting(s) with Analyst(s)/Investor(s) [Participant(s)] on 10th March 2026. This is to further inform that the copy of Investor update has already been submitted with the stock exchanges and has also been uploaded on the website of the Company www.orientbell.com for the information of members and the public at large. Discussions will be based on publicly available information. No unpublished price sensitive information (UPSI) is intended to be discussed during the meeting. Kindly note that changes may happen due to exigencies on the part of Participant (s)/Company. Kindly take the same on record.

The Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Mahendra K Daga

The Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Goodl Team Investment & Trading Company Pvt Ltd

No Upcoming Board Meetings

Orient Bell Ltd. has declared 5% dividend, ex-date: 21 Jul 25

No Splits history available

Orient Bell Ltd. has announced 5:4 bonus issue, ex-date: 15 Jan 07

No Rights history available