Pacific Industries Ltd Falls to 52-Week Low of Rs.129 Amid Continued Downtrend

2026-03-04 10:26:10Pacific Industries Ltd, a player in the diversified consumer products sector, has touched a new 52-week low of Rs.129 today, marking a significant decline amid continued underperformance relative to its sector and broader market indices.

Read full news article

Pacific Industries Ltd is Rated Strong Sell

2026-03-04 10:10:18Pacific Industries Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 28 May 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 04 March 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Pacific Industries Ltd is Rated Strong Sell

2026-02-21 10:10:18Pacific Industries Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 28 May 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 21 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article

Pacific Industries Ltd Falls to 52-Week Low Amidst Continued Financial Struggles

2026-02-17 15:40:09Pacific Industries Ltd, a key player in the diversified consumer products sector, has touched a new 52-week low of Rs.132.6 today, marking a significant milestone in its ongoing price decline. This fresh low comes after a sustained period of negative returns and reflects persistent challenges faced by the company over recent quarters.

Read full news article

Pacific Industries Ltd is Rated Strong Sell

2026-02-10 10:10:48Pacific Industries Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 28 May 2025, reflecting a significant reassessment of the stock’s outlook. However, the analysis and financial metrics presented here are based on the company’s current position as of 10 February 2026, providing investors with the latest insights into its performance and prospects.

Read full news article

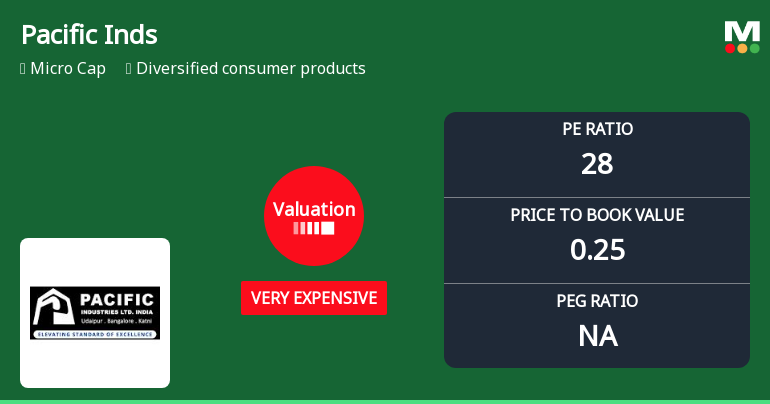

Pacific Industries Ltd Valuation Shifts Signal Elevated Price Risk Amid Mixed Returns

2026-02-10 08:00:13Pacific Industries Ltd, a player in the diversified consumer products sector, has seen a marked shift in its valuation parameters, moving from fair to very expensive territory. This change, coupled with a recent downgrade to a Strong Sell rating by MarketsMOJO, signals a significant reassessment of the stock’s price attractiveness relative to its historical and peer benchmarks.

Read full news articleAre Pacific Industries Ltd latest results good or bad?

2026-02-07 19:18:44Pacific Industries Ltd's latest financial results for Q2 FY26 highlight significant operational challenges. The company reported net sales of ₹39.59 crores, reflecting a sequential decline of 20.28% and a year-on-year drop of 36.69%. This contraction indicates substantial demand headwinds in its core granite and quartz segments. The net profit for the quarter was ₹0.33 crores, which is a sharp decline of 64.52% from the previous quarter and an 85.59% decrease compared to the same period last year. Operating margins also faced pressure, with the operating profit margin (excluding other income) falling to 4.55%, down from 6.75% in Q1 FY26. The profit after tax (PAT) margin decreased to 0.83%, a significant reduction from 1.87% in the prior quarter. These metrics suggest that the company is grappling with severe margin compression, likely due to a combination of pricing pressures and operational inefficienci...

Read full news article

Pacific Industries Q2 FY26: Sharp Profit Decline Amid Revenue Contraction Raises Concerns

2026-02-06 21:00:47Pacific Industries Ltd., the Bangalore-based granite and quartz manufacturer, reported a concerning Q2 FY26 performance with net profit plummeting 64.52% quarter-on-quarter to ₹0.33 crores from ₹0.93 crores in Q1 FY26. On a year-on-year basis, the decline was even more alarming at 85.59% compared to ₹2.29 crores in Q2 FY25. The micro-cap company, with a market capitalisation of ₹103.00 crores, saw its stock surge 8.01% to ₹154.40 following the results announcement, though this appears to be a technical bounce rather than a fundamental endorsement.

Read full news article

Pacific Industries Ltd is Rated Strong Sell

2026-01-30 10:10:35Pacific Industries Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 28 May 2025, but the analysis below reflects the stock’s current position as of 30 January 2026, incorporating the latest fundamentals, returns, and financial metrics available today.

Read full news articleBoard Meeting Outcome for Considering And Approval Of Un-Audited Standalone And Consolidated Financial Results For The Quarter And Nine Months Ended On 31.12.2025

06-Feb-2026 | Source : BSETo Approve Un-Audited Standalone and Consolidated Financial Results for the quarter and nine months ended on 31.12.2025

Result 31.12.2025

06-Feb-2026 | Source : BSEResult 31.12.2025

Board Meeting Intimation for Taking On Record Standalone And Consolidated Unaudited Financial Results Of The Company For The Quarter Ended On 31ST December 2025.

29-Jan-2026 | Source : BSEPacific Industries Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 06/02/2026 inter alia to consider and approve Standalone And Consolidated Unaudited Financial Results Of The Company For The Quarter Ended On 31ST December 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Pacific Industries Ltd has announced 0:0 stock split, ex-date: 18 Jan 08

No Bonus history available

Pacific Industries Ltd has announced 1:1 rights issue, ex-date: 11 Jan 23