Palash Securities Ltd Stock Falls to 52-Week Low Amidst Continued Downtrend

2026-03-04 13:15:14Palash Securities Ltd has reached a new 52-week low, reflecting ongoing pressures on the stock within the FMCG sector. The share price has declined to its lowest level in a year, underscoring a period of sustained underperformance relative to market benchmarks and sector peers.

Read full news article

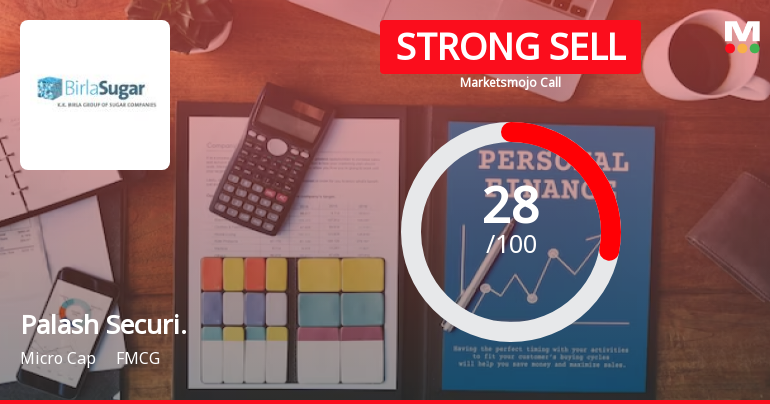

Palash Securities Ltd is Rated Strong Sell

2026-03-03 10:10:34Palash Securities Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 14 February 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 03 March 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Palash Securities Ltd Falls to 52-Week Low Amidst Weak Performance

2026-02-24 14:20:34Palash Securities Ltd has declined to its 52-week low, reflecting ongoing pressures within the FMCG sector and the company’s subdued financial performance. The stock’s latest low price marks a significant point in its year-long downward trajectory, underscoring challenges in sustaining growth and profitability.

Read full news article

Palash Securities Ltd is Rated Strong Sell

2026-02-20 10:10:49Palash Securities Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 14 February 2025. However, the analysis and financial metrics presented here reflect the stock’s current position as of 20 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news article

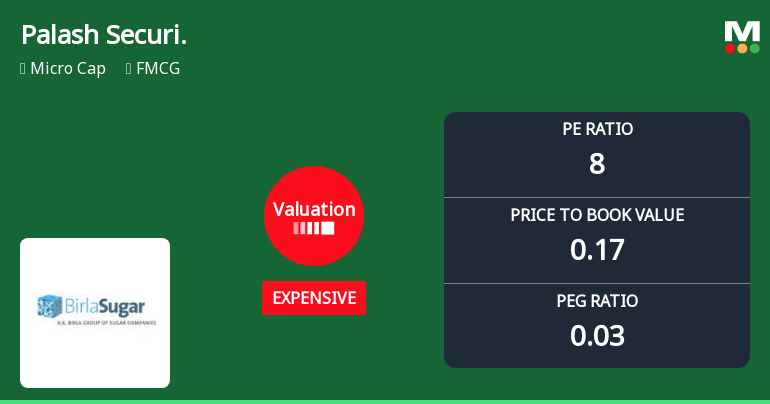

Palash Securities Ltd Valuation Shifts Signal Elevated Price Risk Amid Weak Fundamentals

2026-02-17 08:04:06Palash Securities Ltd, a micro-cap player in the FMCG sector, has seen a notable shift in its valuation parameters, moving from a risky to an expensive classification. Despite a recent uptick in share price, the company’s fundamental metrics and returns relative to the Sensex paint a complex picture for investors assessing its price attractiveness and long-term potential.

Read full news article

Palash Securities Ltd Falls to 52-Week Low Amidst Continued Underperformance

2026-02-09 10:35:56Palash Securities Ltd, a player in the FMCG sector, has declined to its 52-week low price, reflecting ongoing financial pressures and subdued market performance. The stock closed at its lowest level in a year, signalling persistent challenges within the company’s fundamentals despite a broadly positive market environment.

Read full news article

Palash Securities Ltd is Rated Strong Sell

2026-02-09 10:10:30Palash Securities Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 14 February 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 09 February 2026, providing investors with an up-to-date perspective on the company’s fundamentals, valuation, financial trend, and technical outlook.

Read full news articleWhen is the next results date for Palash Securities Ltd?

2026-02-05 23:18:29The next results date for Palash Securities Ltd is scheduled for 13 February 2026....

Read full news article

Palash Securities Ltd Falls to 52-Week Low Amidst Continued Downtrend

2026-02-05 12:10:22Palash Securities Ltd’s share price has declined to a fresh 52-week low, touching an intraday low of Rs 94.2 on 5 Feb 2026, marking a significant milestone in the stock’s ongoing downward trajectory within the FMCG sector.

Read full news articleAnnouncement under Regulation 30 (LODR)-Newspaper Publication

14-Feb-2026 | Source : BSECopy of Newspaper advertisement

Board Meeting Outcome for Outcome Of Board Meeting - Unaudited Financial Results For The Quarter And Nine Months Ended 31St December 2025

13-Feb-2026 | Source : BSEPursuant to Regulation 30 and 33 of SEBI (Listing Obligations & Disclosure Requirements) Regulations 2015 we wish to inform you that the Board of Directors of the Company at its meeting held today i.e. 13th February 2026 has inter-alia considered and approved the Unaudited Financial Results (both Standalone and Consolidated) for the quarter and nine months ended 31st December 2025 along with Auditors Limited Review Report thereon. A copy of Unaudited Financial Results (both Standalone and Consolidated) along with Auditors Limited Review Report thereon is enclosed for your records. The above results are also being made available on the Companys website at www.birlasugar.com The meeting commenced at 4:30 p.m. and concluded at 7:25 p.m. The above is for your information and dissemination to all concerned.

Unaudited Financial Results For The Quarter And Nine Months Ended 31St December 2025

13-Feb-2026 | Source : BSEUnaudited Financial Results for the Quarter and Nine months ended 31st December 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available