Strong Price Performance Against Benchmarks

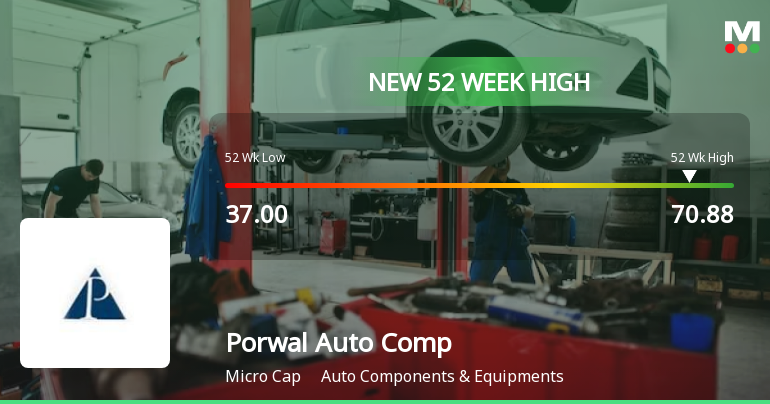

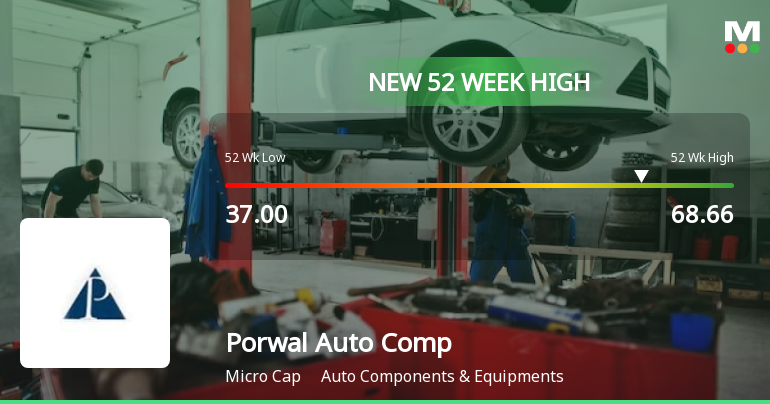

Porwal Auto Components Ltd’s recent price movement stands out distinctly when compared to broader market indices. Over the past week, the stock has appreciated by 14.22%, markedly outperforming the Sensex’s modest 2.94% gain. This outperformance extends over longer periods as well, with the stock rising 18.18% in the last month against the Sensex’s 0.59%, and delivering a year-to-date return of 14.44% while the Sensex has declined by 1.36%. Such sustained gains highlight the stock’s strong momentum and investor confidence relative to the broader market.

Moreover, the stock’s one-year return of 27.35% significantly surpasses the Sensex’s 7.97%, and its three- and five-year returns of 176.60% and 185.71% respectively dwarf the ...

Read full news article