Key Events This Week

2 Feb: Stock opens at Rs.32.04, down 2.35%

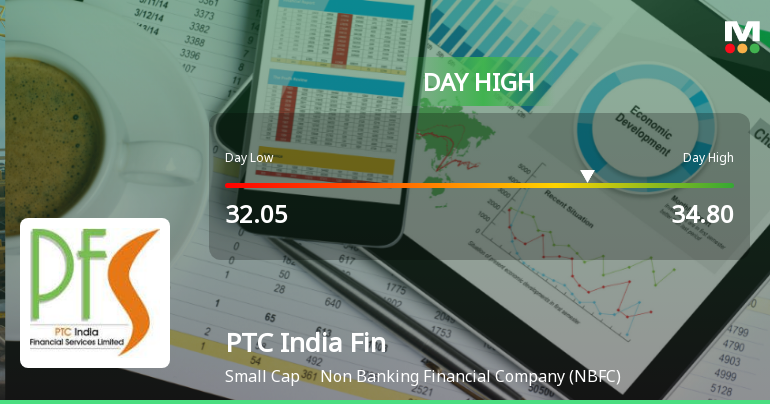

3 Feb: Intraday high of Rs.34.35 with 7.71% surge

4 Feb: Mixed technical signals amid price momentum shift

6 Feb: Week closes at Rs.33.61, up 2.44% for the week

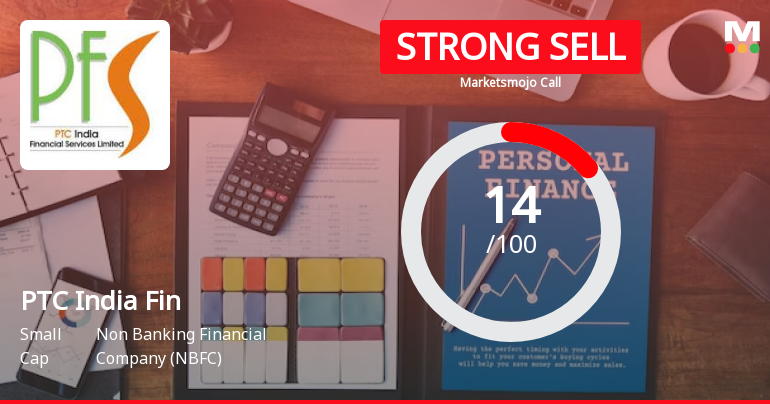

PTC India Financial Services Ltd is Rated Strong Sell

2026-02-04 10:10:33PTC India Financial Services Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 07 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 04 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

PTC India Financial Services Ltd Sees Mixed Technical Signals Amid Price Momentum Shift

2026-02-04 08:01:48PTC India Financial Services Ltd (PTC India Fin), a key player in the Non Banking Financial Company (NBFC) sector, has experienced a notable shift in its technical momentum, reflected in a recent upgrade of its MarketsMOJO rating from Sell to Strong Sell. Despite a robust 6.84% gain in the latest trading session, the stock’s technical indicators present a complex picture, with bearish trends persisting on weekly and monthly charts, while some short-term signals hint at mild bullishness.

Read full news article

PTC India Financial Services Ltd Hits Intraday High with 7.71% Surge on 3 Feb 2026

2026-02-03 14:01:29PTC India Financial Services Ltd recorded a robust intraday performance on 3 Feb 2026, surging to an intraday high of Rs 34.35, marking a 7.21% gain and outperforming its sector and the broader market amid a notable rebound after four consecutive days of decline.

Read full news articlePTC India Financial Services Ltd Gains 10.17%: 3 Key Factors Driving the Week’s Momentum

2026-01-31 17:13:35

Key Events This Week

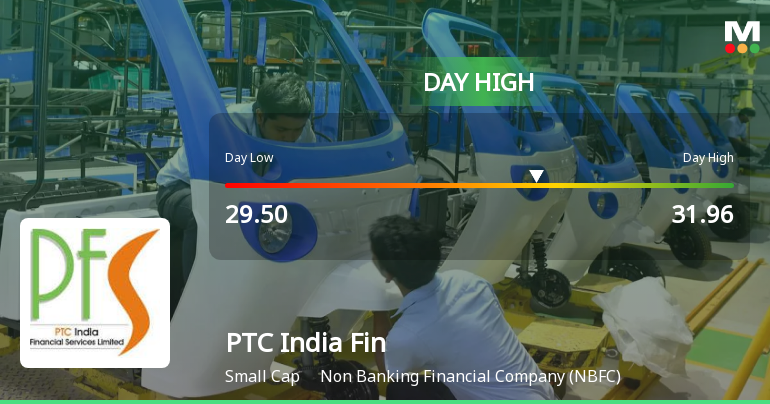

Jan 27: Intraday high surge of 7.12% to Rs.31.9

Jan 28: Continued rally with 5.91% gain, reaching Rs.33.95 intraday

Jan 29: Mixed technical signals amid mild momentum shift

Jan 30: Bearish momentum emerges, stock closes at Rs.32.81 (-0.79%)

PTC India Financial Services Ltd Faces Bearish Momentum Amid Technical Downturn

2026-01-30 08:00:55PTC India Financial Services Ltd (PTC India Fin), a key player in the Non Banking Financial Company (NBFC) sector, has experienced a notable shift in its technical momentum, signalling a bearish trend. Recent technical indicators including MACD, RSI, and moving averages suggest a deteriorating outlook, with the stock currently trading at ₹32.76, down 2.82% from its previous close of ₹33.71.

Read full news article

PTC India Financial Services Ltd Sees Mixed Technical Signals Amid Mild Momentum Shift

2026-01-29 08:00:55PTC India Financial Services Ltd has experienced a notable shift in price momentum, reflected in a complex array of technical indicators that suggest a transition from a bearish to a mildly bearish trend. Despite a strong intraday gain of 5.91%, the stock’s technical landscape remains nuanced, with key metrics such as MACD, RSI, and moving averages signalling caution for investors navigating the Non Banking Financial Company (NBFC) sector.

Read full news article

PTC India Financial Services Ltd Hits Intraday High with 7.12% Surge

2026-01-27 15:01:04PTC India Financial Services Ltd recorded a robust intraday performance on 27 Jan 2026, surging 7.12% to touch a day’s high of Rs 31.9, significantly outperforming the broader Sensex which gained 0.21% during the session.

Read full news article

PTC India Financial Services Ltd is Rated Strong Sell

2026-01-24 10:10:15PTC India Financial Services Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 07 Nov 2025, reflecting a significant reassessment of the stock’s outlook. However, the analysis and financial metrics discussed here represent the company’s current position as of 24 January 2026, providing investors with the latest data to understand the rationale behind this recommendation.

Read full news articleAnnouncement under Regulation 30 (LODR)-Newspaper Publication

28-Jan-2026 | Source : BSENewspaper advertisement for Postal Ballot Notice

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

27-Jan-2026 | Source : BSENotice of Postal Ballot for the appointment of Mr. Pikkili Ramana Murthy (DIN: 07815852) as an Independent Director of the Company

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

23-Jan-2026 | Source : BSEEarning call transcript for the investor call held on Wednesday 21st January 2026 at 10:00 A.M.

Corporate Actions

No Upcoming Board Meetings

PTC India Financial Services Ltd has declared 10% dividend, ex-date: 05 Sep 23

No Splits history available

No Bonus history available

No Rights history available