Puretrop Fruits Ltd Downgraded to Sell Amid Mixed Technicals and Valuation Concerns

2026-03-03 08:00:47Puretrop Fruits Ltd, a player in the Other Agricultural Products sector, has seen its investment rating downgraded from Hold to Sell as of 2 March 2026. This shift reflects a complex interplay of technical indicators, valuation metrics, financial trends, and quality assessments that collectively signal caution for investors despite the company’s recent positive quarterly performance.

Read full news article

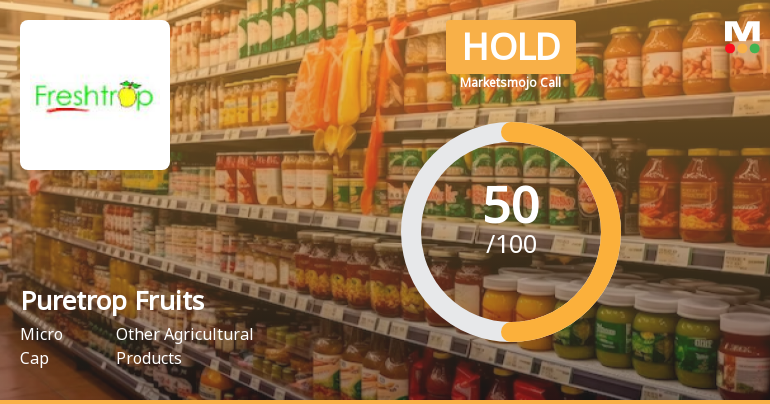

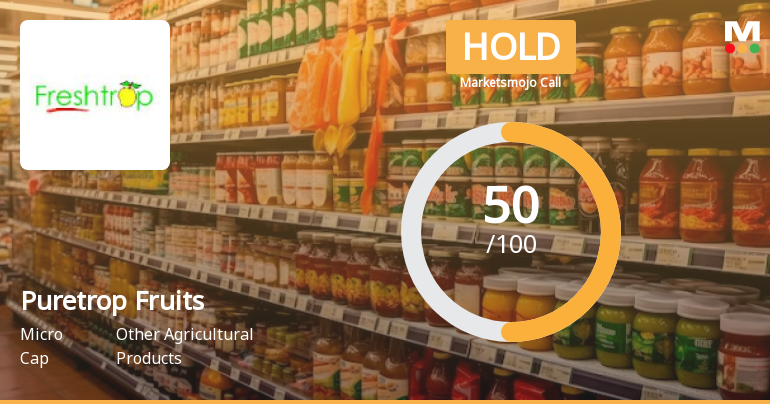

Puretrop Fruits Ltd is Rated Hold by MarketsMOJO

2026-03-02 10:10:49Puretrop Fruits Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 13 January 2026. However, the analysis and financial metrics discussed here reflect the company’s current position as of 02 March 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Puretrop Fruits Ltd is Rated Hold by MarketsMOJO

2026-02-19 10:11:15Puretrop Fruits Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 13 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 19 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Puretrop Fruits Ltd is Rated Hold by MarketsMOJO

2026-02-08 10:10:41Puretrop Fruits Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 13 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 08 February 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article

Puretrop Fruits Ltd is Rated Hold by MarketsMOJO

2026-01-28 10:10:51Puretrop Fruits Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 13 January 2026. However, the analysis and financial metrics discussed here reflect the company’s current position as of 28 January 2026, providing investors with an up-to-date view of the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Puretrop Fruits Ltd Hits New 52-Week High of Rs.200 on 14 Jan 2026

2026-01-14 09:40:07Puretrop Fruits Ltd has surged to a fresh 52-week high, touching Rs.200 today, reflecting robust momentum in the Other Agricultural Products sector. This milestone underscores the stock’s sustained upward trajectory amid a volatile market backdrop.

Read full news articleWhen is the next results date for Puretrop Fruits Ltd?

2026-01-08 23:16:08The next results date for Puretrop Fruits Ltd is scheduled for 12 January 2026....

Read full news article

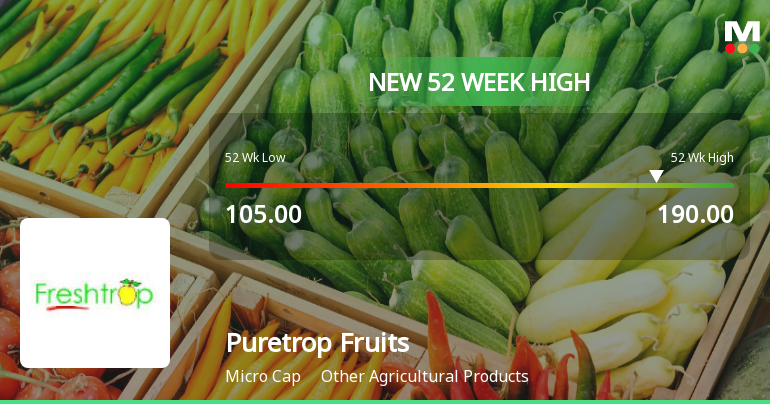

Puretrop Fruits Ltd Hits New 52-Week High of Rs.190

2026-01-08 09:20:05Puretrop Fruits Ltd has surged to a fresh 52-week high, touching Rs.190 today, marking a significant milestone in its stock performance and reflecting strong momentum within the Other Agricultural Products sector.

Read full news article

Puretrop Fruits Ltd is Rated Sell by MarketsMOJO

2026-01-06 10:10:10Puretrop Fruits Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 30 October 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 06 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news articleCorporate Action- Fix Record Date For Buy Back Of Equity Shares

24-Feb-2026 | Source : BSEIntimation of Record Date under Regulation 42 of the SEBI(Listing Obligations and Disclosure Requirements) Regualtions 2015

Announcement under Regulation 30 (LODR)-Newspaper Publication

23-Feb-2026 | Source : BSESubmission of Newspaper Publication of Public Announcement pursuant to provisions of SEBI (Buy-Back of Securities) Regulations 2018

Announcement under Regulation 30 (LODR)-Public Announcement-Buyback of Shares

23-Feb-2026 | Source : BSESubmission of Public Announcement pursuant to the provision of the SEBI (Buy-Back of Securities) Regulation 2018

Corporate Actions

No Upcoming Board Meetings

Puretrop Fruits Ltd has declared 10% dividend, ex-date: 21 Sep 16

No Splits history available

Puretrop Fruits Ltd has announced 1:1 bonus issue, ex-date: 03 Jan 08

No Rights history available