Short-Term Outperformance Against Benchmarks

Radaan Mediaworks has demonstrated strong recent gains, with the stock appreciating 7.83% over the past week and 8.81% in the last month. This contrasts sharply with the Sensex, which declined by 0.52% over the week and rose modestly by 0.95% over the month. Such outperformance indicates renewed investor interest and confidence in the stock's near-term prospects, possibly driven by technical factors or sector-specific developments.

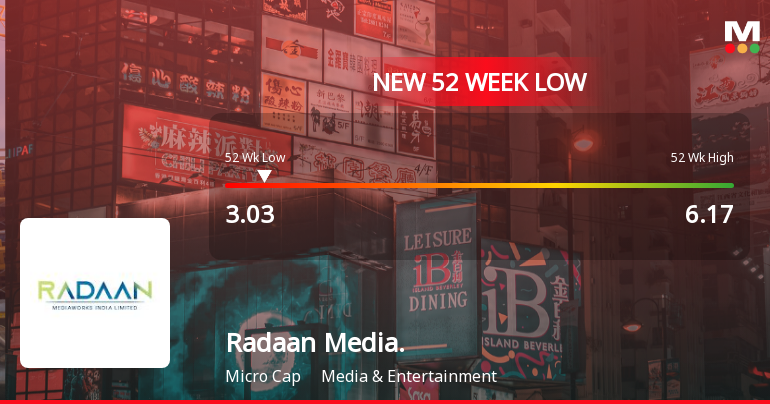

However, it is important to contextualise these gains within the stock's longer-term trajectory. Year-to-date, Radaan Mediaworks remains down by 51.29%, significantly underperforming the Sensex's 9.12% gain. Over the past year, the stock has declined 41.02%, while the benchmark index rose 4.89%. T...

Read full news article