Key Events This Week

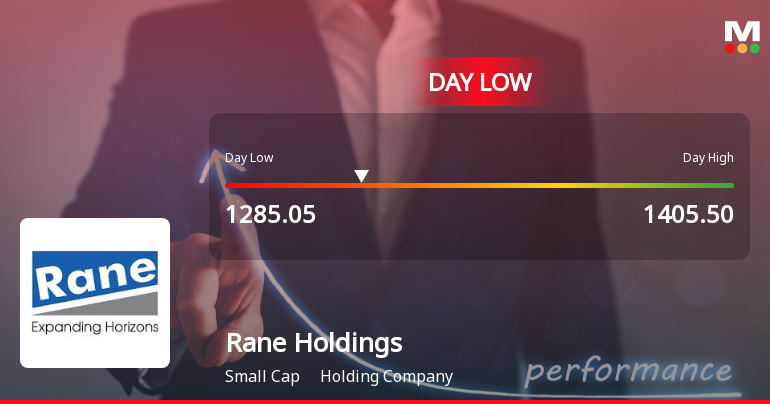

16 Feb: Intraday low hit amid heavy price pressure (Rs.1,322.20)

17 Feb: Technical downgrade triggers further bearish momentum

18 Feb: Minor recovery with slight price gain (+0.14%)

19 Feb: Continued decline despite Sensex dip

20 Feb: Week closes at Rs.1,231.25, down 14.83%