Ranger Energy Services, Inc. Experiences Revision in Its Stock Evaluation Amid Strong Financial Metrics

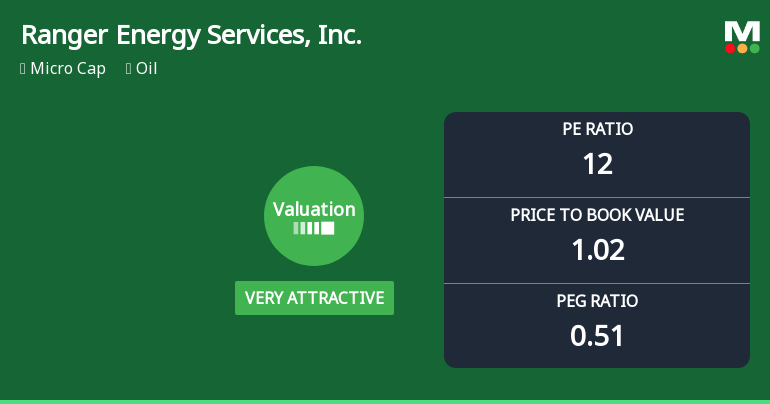

2025-11-03 16:09:41Ranger Energy Services, Inc. has recently adjusted its valuation, showcasing a P/E ratio of 12 and a price-to-book value of 1.02. The company features a high dividend yield of 142.49% and solid returns on capital and equity, positioning it favorably compared to peers in the oil industry.

Read full news article

Ranger Energy Services Forms Golden Cross, Signals Potential Bullish Breakout

2025-10-30 15:37:54Ranger Energy Services, Inc. has recently achieved a Golden Cross, indicating a potential shift in momentum. The stock has outperformed the S&P 500 in daily and weekly performance, despite a year-to-date decline. Technical indicators suggest a bullish sentiment, hinting at possible upward movement in the near future.

Read full news articleNo announcement available

Corporate Actions

No corporate action available