Key Events This Week

Feb 9: Stock opens at Rs.41.94, marginal decline despite Sensex rally

Feb 10: Sharp intraday gain of 4.39% on low volume

Feb 11: Significant drop of 4.98% following mixed market cues

Feb 13: Quarterly results reveal positive turnaround but stock closes lower at Rs.40.00 (-3.85%)

Are Ras Resorts & Apart Hotels Ltd latest results good or bad?

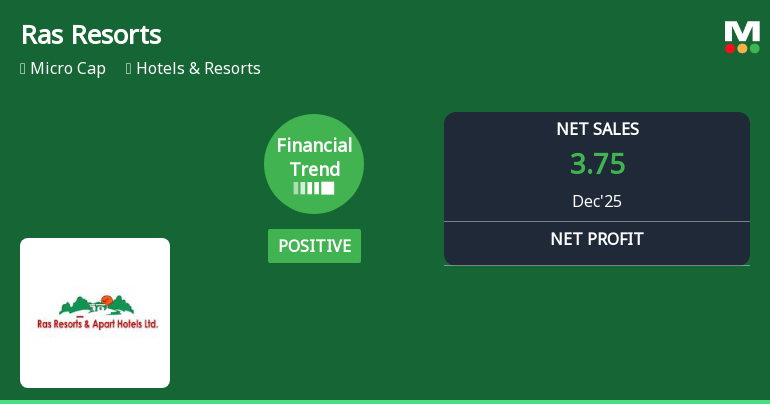

2026-02-14 19:38:31Ras Resorts & Apart Hotels Ltd's latest financial results for Q3 FY26 reflect a complex operational landscape. The company reported net sales of ₹3.75 crores, which represents a 1.90% increase year-on-year, indicating a struggle to maintain revenue growth in a recovering hospitality sector. This modest growth contrasts sharply with the 54.32% quarter-on-quarter increase, highlighting the seasonal volatility typical in the hospitality industry. Net profit for the quarter reached ₹0.30 crores, marking a significant 130.77% increase from the previous year, driven by improved operating leverage as revenues recovered. The operating margin also improved to 15.47%, up from 9.88% in the previous quarter, suggesting better absorption of fixed costs during this peak season. However, the full-year revenue for FY25 was reported at ₹12.00 crores, down 7.70% from the prior year, raising concerns about the company's abil...

Read full news article

Ras Resorts & Apart Hotels Ltd Reports Positive Quarterly Financial Turnaround Amid Market Challenges

2026-02-13 14:00:10Ras Resorts & Apart Hotels Ltd has demonstrated a notable positive shift in its financial trend for the quarter ended December 2025, marking a departure from previous flat performance. Despite ongoing market headwinds and a challenging sector environment, the company posted its highest quarterly earnings and profitability metrics in recent history, signalling a potential inflection point for investors.

Read full news article

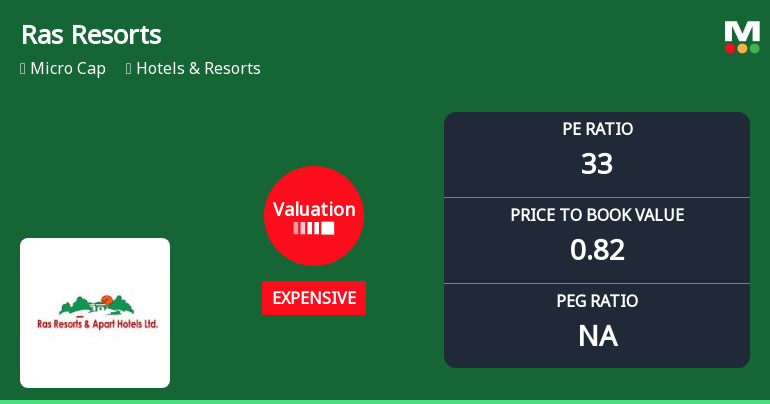

Ras Resorts Q3 FY26: Profit Surge Masks Underlying Weakness in Micro-Cap Hospitality Player

2026-02-13 11:48:27Ras Resorts & Apart Hotels Ltd. reported a sharp quarterly profit rebound in Q3 FY26, with net profit surging to ₹0.30 crores—the highest in recent quarters—yet the micro-cap hospitality company's stock continues to languish near 52-week lows, trading at ₹40.00 with a market capitalisation of just ₹15.88 crores. Despite the sequential improvement, the Daman-based resort operator faces mounting concerns over weak profitability metrics, elevated valuations relative to fundamentals, and persistent underperformance against both sectoral peers and broader market indices.

Read full news article

Ras Resorts & Apart Hotels Ltd Falls to 52-Week Low Amidst Weak Fundamentals

2026-01-22 11:46:33Ras Resorts & Apart Hotels Ltd has declined to a fresh 52-week low of Rs.33.34, marking a significant downturn amid a period of sustained negative returns and heightened volatility. The stock’s recent performance reflects ongoing pressures within the Hotels & Resorts sector, compounded by company-specific financial metrics and market dynamics.

Read full news article

Ras Resorts & Apart Hotels Ltd is Rated Strong Sell

2025-12-26 15:12:32Ras Resorts & Apart Hotels Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 28 April 2025. However, the analysis and financial metrics presented here reflect the company’s current position as of 26 December 2025, providing investors with an up-to-date view of the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news articleWhy is Ras Resorts falling/rising?

2025-12-20 02:16:45

Short-Term Gains Amid Broader Market Underperformance

Ras Resorts has demonstrated resilience in the short term, with its share price appreciating by 1.01% over the past week and 2.46% in the last month. This contrasts with the broader Sensex index, which declined by 0.40% and 0.30% respectively over the same periods. The stock’s recent two-day consecutive gains have contributed to a cumulative return of 1.23%, signalling renewed investor interest and confidence in the near term.

Despite this short-term strength, the stock underperformed its sector on the day, lagging by 0.88%. However, the upward movement is supported by technical indicators, as the current price remains above the 5-day, 20-day, 50-day, and 100-day moving averages. This suggests a positive trend in th...

Read full news article

Ras Resorts Sees Revision in Market Assessment Amidst Challenging Fundamentals

2025-12-09 10:10:07Ras Resorts, a microcap player in the Hotels & Resorts sector, has experienced a notable revision in its market evaluation. This shift reflects changes across key analytical parameters including quality, valuation, financial trends, and technical outlook, highlighting the challenges the company currently faces in a competitive and volatile market environment.

Read full news article