Short-Term Gains Amid Broader Market Underperformance

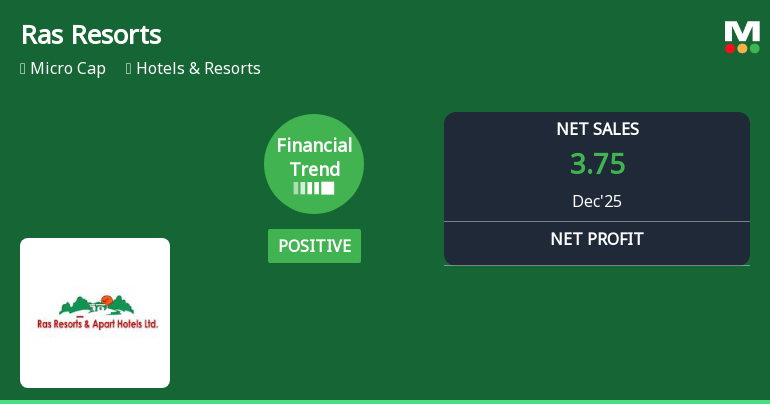

Ras Resorts has demonstrated resilience in the short term, with its share price appreciating by 1.01% over the past week and 2.46% in the last month. This contrasts with the broader Sensex index, which declined by 0.40% and 0.30% respectively over the same periods. The stock’s recent two-day consecutive gains have contributed to a cumulative return of 1.23%, signalling renewed investor interest and confidence in the near term.

Despite this short-term strength, the stock underperformed its sector on the day, lagging by 0.88%. However, the upward movement is supported by technical indicators, as the current price remains above the 5-day, 20-day, 50-day, and 100-day moving averages. This suggests a positive trend in th...

Read full news article