Are Restaurant Brands Asia Ltd latest results good or bad?

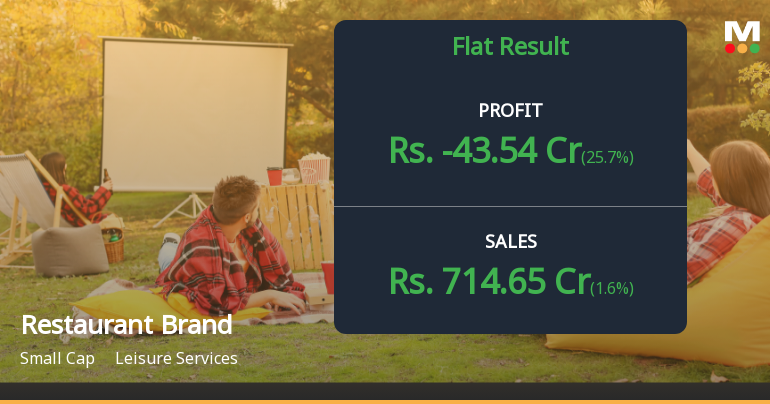

2026-02-04 19:23:30Restaurant Brands Asia Ltd's latest financial results for Q3 FY26 present a complex picture of operational performance amidst ongoing challenges. The company reported consolidated net sales of ₹714.65 crores, reflecting a quarter-on-quarter growth of 1.60% and an impressive year-on-year increase of 11.83%. This marks the highest quarterly revenue achieved to date, driven by both same-store sales growth and the addition of new outlets in its Burger King network. Operationally, the company demonstrated improved efficiency, with operating margins (excluding other income) expanding to 12.53%, the highest level in seven quarters, indicating better absorption of fixed costs and enhanced cost management. The operating profit before depreciation, interest, tax, and other income (PBDIT) rose significantly to ₹89.51 crores, up 26.13% from the previous quarter. However, despite these operational gains, Restaurant Br...

Read full news article

Restaurant Brands Asia Q3 FY26: Losses Deepen Despite Revenue Growth as Expansion Costs Bite

2026-02-03 19:33:17Restaurant Brands Asia Limited, the master franchisee for Burger King in India and Indonesia, reported a consolidated net loss of ₹43.54 crores for Q3 FY26, marking a 13.61% deterioration from the ₹50.40 crores loss in the year-ago quarter. Despite posting its highest-ever quarterly revenue of ₹714.65 crores—up 11.83% year-on-year—the company continues to grapple with mounting depreciation and interest costs that have kept profitability elusive. The stock, currently trading at ₹63.57, has tumbled 16.56% over the past year and remains 29.00% below its 52-week high of ₹89.53, reflecting sustained investor pessimism about the quick-service restaurant operator's path to profitability.

Read full news article

Restaurant Brands Asia Ltd is Rated Strong Sell

2026-02-01 10:10:22Restaurant Brands Asia Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 29 September 2025. However, the analysis and financial metrics presented here reflect the stock’s current position as of 01 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news articleWhen is the next results date for Restaurant Brands Asia Ltd?

2026-01-28 23:16:45The next results date for Restaurant Brands Asia Ltd is scheduled for February 3, 2026....

Read full news article

Restaurant Brands Asia Ltd is Rated Strong Sell

2026-01-21 10:10:20Restaurant Brands Asia Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 29 September 2025, reflecting a reassessment of the stock’s outlook. However, the analysis and financial metrics presented here are based on the company’s current position as of 21 January 2026, providing investors with the latest insights into its performance and prospects.

Read full news article

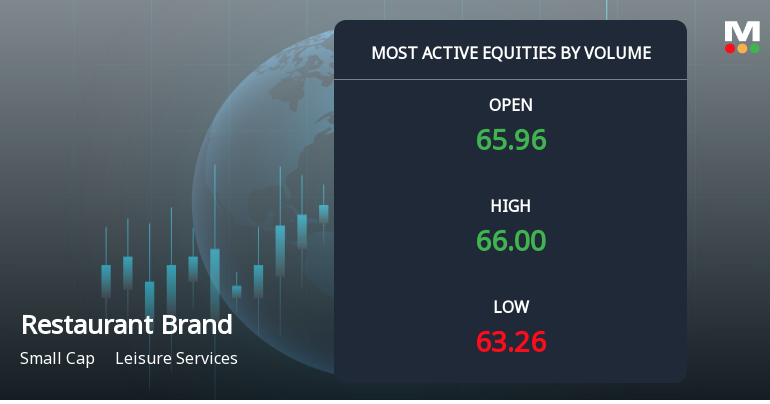

Restaurant Brands Asia Ltd Sees Exceptional Volume Surge Amid Mixed Price Action

2026-01-21 10:00:16Restaurant Brands Asia Ltd (RBA), a key player in the Leisure Services sector, witnessed one of the highest trading volumes on 21 Jan 2026, with over 1.1 crore shares exchanging hands. Despite a modest price decline, the stock outperformed its sector, signalling heightened investor interest and potential accumulation signals amid mixed technical indicators.

Read full news article

Restaurant Brands Asia Ltd is Rated Strong Sell

2026-01-10 10:10:20Restaurant Brands Asia Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 29 September 2025, reflecting a reassessment of the stock’s outlook. However, the analysis and financial metrics presented here are based on the company’s current position as of 10 January 2026, providing investors with the latest data to understand the rationale behind this recommendation.

Read full news article

Restaurant Brands Asia Ltd Sees Mixed Technical Signals Amid Price Momentum Shift

2026-01-05 08:08:47Restaurant Brands Asia Ltd has experienced a notable shift in price momentum, reflected in a complex array of technical indicators that suggest a cautious outlook for investors. Despite a recent uptick in share price, the company’s technical parameters reveal a predominantly bearish stance with subtle signs of mild recovery, underscoring the need for careful analysis in the leisure services sector.

Read full news article

Restaurant Brands Asia Ltd is Rated Strong Sell

2025-12-30 10:10:04Restaurant Brands Asia Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 29 September 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 30 December 2025, providing investors with the most up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news articleAnnouncement under Regulation 30 (LODR)-Newspaper Publication

07-Feb-2026 | Source : BSENewspaper publication of the Corrigendum to the Notice of 01/2025-26 Extra-Ordinary General Meeting of the Company.

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

06-Feb-2026 | Source : BSEInvestors and Analyst Call Transcript

Corrigendum To The Notice Of 01/2025-26 Extra-Ordinary General Meeting Of Restaurant Brands Asia Limited

06-Feb-2026 | Source : BSECorrigendum to the Notice of 01/2025-26 Extra-Ordinary General Meeting of Restaurant Brands Asia Limited

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available