Rossell India Ltd is Rated Sell

2026-03-02 10:10:49Rossell India Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 27 Feb 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 02 March 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Rossell India Ltd is Rated Sell by MarketsMOJO

2026-02-19 10:11:15Rossell India Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 11 February 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 19 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Rossell India Ltd is Rated Strong Sell

2026-02-08 10:10:41Rossell India Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 06 February 2026, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed below are current as of 08 February 2026, providing investors with the latest view of the company’s position.

Read full news article

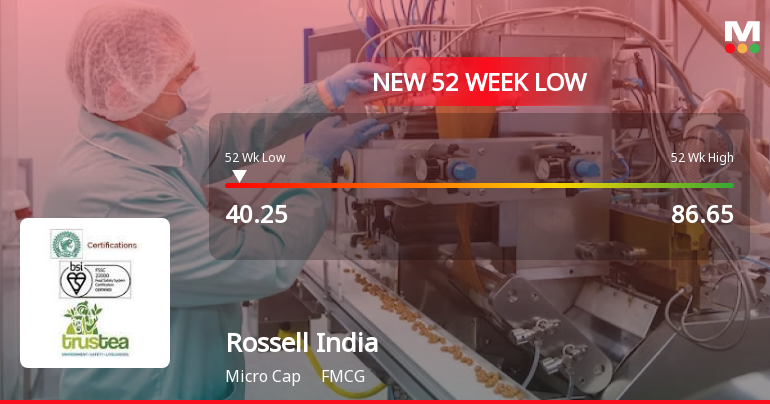

Rossell India Ltd Stock Falls to 52-Week Low of Rs.40.25

2026-02-02 14:37:11Rossell India Ltd’s stock touched a fresh 52-week low of Rs.40.25 today, marking a significant decline amid ongoing challenges in its financial and market performance. The stock underperformed its sector and broader market indices, reflecting persistent headwinds for the FMCG company.

Read full news articleWhen is the next results date for Rossell India Ltd?

2026-01-28 23:16:36The next results date for Rossell India Ltd is scheduled for 10 February 2026....

Read full news article

Rossell India Ltd is Rated Strong Sell

2026-01-28 10:10:51Rossell India Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 08 December 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 28 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Rossell India Ltd Falls to 52-Week Low of Rs.40.3 Amid Continued Downtrend

2026-01-27 10:29:39Rossell India Ltd’s shares declined sharply to a fresh 52-week low of Rs.40.3 today, marking a significant milestone in the stock’s ongoing downward trajectory. The stock has now recorded a seven-day consecutive fall, accumulating a loss of 14.1% over this period, reflecting persistent pressures on the company’s market valuation.

Read full news article

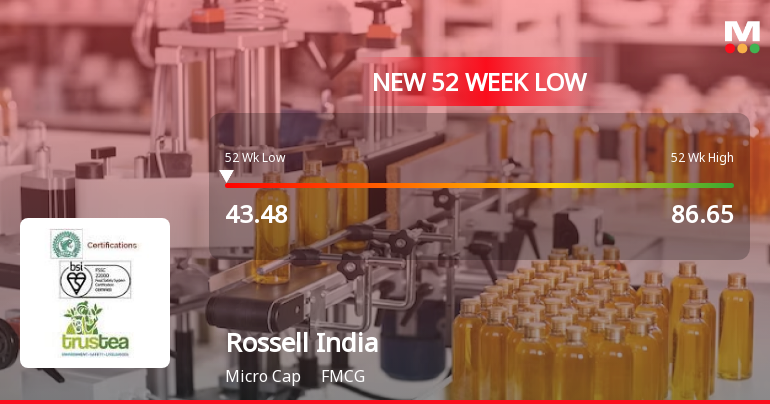

Rossell India Ltd Stock Hits 52-Week Low Amidst Continued Downtrend

2026-01-23 14:18:04Rossell India Ltd’s shares declined to a fresh 52-week low of Rs.43.48 on 23 Jan 2026, marking a significant milestone in the stock’s ongoing downward trajectory. The stock has underperformed both its sector and broader market indices, reflecting a series of financial and market pressures over the past year.

Read full news article

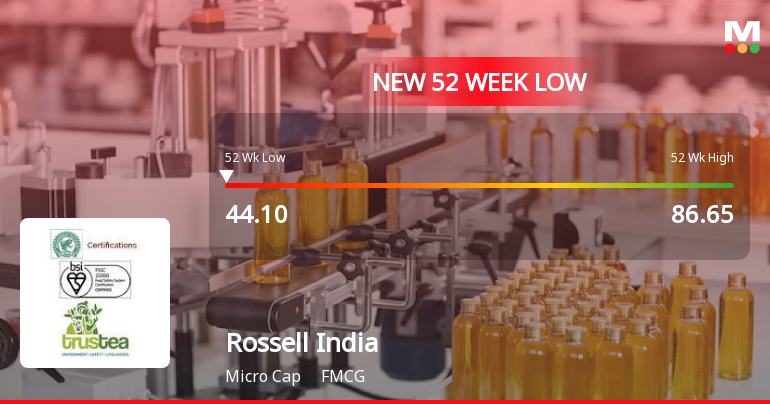

Rossell India Ltd Stock Hits 52-Week Low Amidst Continued Downtrend

2026-01-22 11:00:28Rossell India Ltd’s shares declined to a fresh 52-week low of Rs.44.21 on 22 Jan 2026, marking a significant milestone in the stock’s ongoing downward trajectory. The stock has underperformed its sector and broader market indices, reflecting persistent challenges in its financial and market performance.

Read full news articleCREDIT RATINGS

24-Feb-2026 | Source : BSEEnclosed the letter pertaining to the credit rating in respect of various credit facilities made available by financing banks to the Company.

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

23-Feb-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Samara Gupta & PACs

Disclosures under Reg. 10(6) of SEBI (SAST) Regulations 2011

23-Feb-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 10(6) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Samara Gupta

Corporate Actions

No Upcoming Board Meetings

Rossell India Ltd has declared 20% dividend, ex-date: 14 Aug 25

Rossell India Ltd has announced 2:10 stock split, ex-date: 20 Jan 11

No Bonus history available

No Rights history available