Key Events This Week

09 Feb: Stock opens strong at Rs.59.94, up 5.03%

10 Feb: Q2 FY26 results reveal 310% profit surge, stock rises to Rs.61.97

11 Feb: Positive quarterly growth reported, stock dips to Rs.60.55

12 Feb: Stock declines further to Rs.59.51 amid market weakness

13 Feb: Week closes at Rs.59.50, marginally down from prior day

Has S P Capital Financing Ltd declared dividend?

2026-02-11 23:30:58S P Capital Financing Ltd has declared a 5% dividend. Dividend Details: - Percentage announced: 5% - Ex-date: 13 Feb 26 Dividend Yield: 0.81%. Total Returns by Period: In the 3-month period, the price return was 2.32%, the dividend return was 0.84%, resulting in a total return of 3.16%. Over the 6-month period, the price return was 25.53%, with a dividend return of 2.18%, leading to a total return of 27.71%. For the 1-year period, the price return was 18.95%, the dividend return was 1.59%, culminating in a total return of 20.54%. In the 2-year period, the price return was 44.89%, the dividend return was 4.78%, which resulted in a total return of 49.67%. During the 3-year period, the price return was 266.46%, with a dividend return of 18.52%, achieving a total return of 284.98%. For the 4-year period, the price return was 133.66%, the dividend return was 18.45%, resulting in a total return of 152.11%...

Read full news article

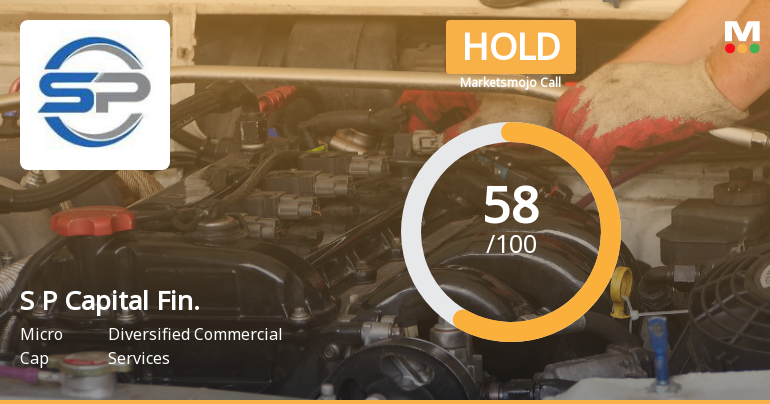

S P Capital Financing Ltd is Rated Hold by MarketsMOJO

2026-02-11 10:11:38S P Capital Financing Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 27 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 11 February 2026, providing investors with the most up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

S P Capital Financing Ltd Reports Positive Quarterly Growth Amid Market Outperformance

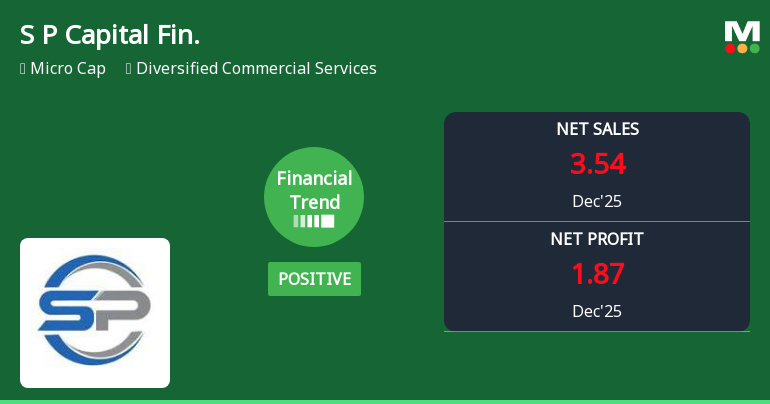

2026-02-11 08:00:09S P Capital Financing Ltd has demonstrated a notable improvement in its financial performance for the quarter ended December 2025, signalling a positive shift in its growth trajectory. The company’s recent results reveal robust revenue expansion and profit growth, supported by a favourable market environment and strategic operational execution.

Read full news articleAre S P Capital Financing Ltd latest results good or bad?

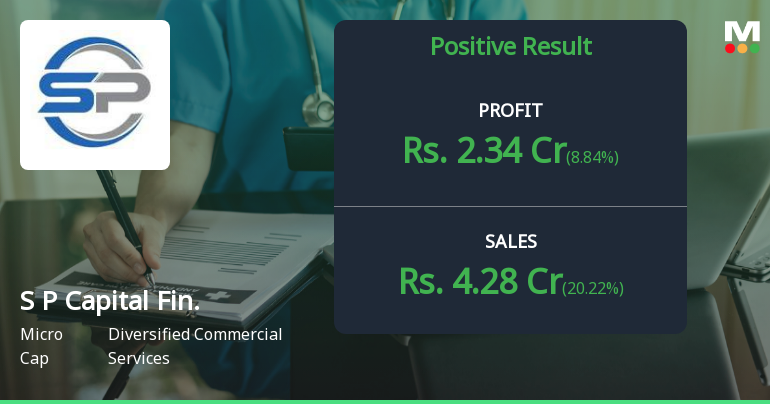

2026-02-10 19:20:55S P Capital Financing Ltd's latest financial results for Q2 FY26 indicate a significant year-on-year growth in net profit and net sales, with net profit reported at ₹2.34 crores, reflecting a 310.53% increase compared to the previous year. Net sales also showed robust growth, reaching ₹4.28 crores, which is a 176.13% increase year-on-year. The operating margin stood at a high 93.46%, marking an improvement from the previous year's figure, showcasing the company's operational efficiency. However, the results also reveal some underlying concerns. The company's balance sheet reflects a high leverage profile, with a net debt-to-equity ratio of 3.62, raising questions about financial sustainability. Current liabilities surged significantly, increasing by 76.35% year-on-year, which outpaced revenue growth and could pose risks in a rising interest rate environment. Additionally, the absence of institutional inves...

Read full news article

S P Capital Financing Q2 FY26: Stellar 310% Profit Surge Masks Underlying Leverage Concerns

2026-02-10 17:45:39S P Capital Financing Limited, a Mumbai-based micro-cap finance and investment company, delivered an impressive quarterly performance in Q2 FY26, with consolidated net profit surging 310.53% year-on-year to ₹2.34 crores from ₹0.57 crores in Q2 FY25. On a sequential basis, profit advanced 8.84% from ₹2.15 crores in Q1 FY26. The company, with a market capitalisation of ₹35.00 crores, saw its stock price climb 3.39% to ₹61.97 following the results announcement, reflecting investor optimism about the earnings trajectory.

Read full news article

S P Capital Financing Ltd Upgraded to Hold on Improved Technicals and Financial Performance

2026-01-28 08:00:51S P Capital Financing Ltd, a key player in the diversified commercial services sector, has seen its investment rating upgraded from Sell to Hold as of 27 Jan 2026. This change reflects a combination of improved technical indicators, robust financial performance, attractive valuation metrics, and a cautiously optimistic outlook on quality parameters, signalling a more favourable stance for investors.

Read full news article

S P Capital Financing Ltd Downgraded to Sell Amid Mixed Financial and Technical Signals

2026-01-22 08:01:04S P Capital Financing Ltd has seen its investment rating downgraded from Hold to Sell as of 21 Jan 2026, reflecting a complex interplay of technical, valuation, financial trend, and quality factors. Despite strong recent financial performance, the company faces challenges in long-term fundamentals and technical indicators, prompting a cautious stance from analysts.

Read full news article

S P Capital Financing Ltd is Rated Hold

2026-01-03 10:10:34S P Capital Financing Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 22 December 2025. While the rating change occurred then, the analysis and financial metrics discussed here reflect the company’s current position as of 03 January 2026, providing investors with the most up-to-date insight into the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article