Safe Bulkers, Inc. Hits New 52-Week High at $5.00

2025-11-12 16:10:43Safe Bulkers, Inc. has achieved a new 52-week high of USD 5.00, reflecting a positive shift in stock performance despite a one-year decline of 17.74%. With a market cap of USD 456 million, a P/E ratio of 5.00, and a dividend yield of 4.89%, the company shows potential for income-focused investors.

Read full news article

Safe Bulkers, Inc. Hits New 52-Week High of $4.99

2025-11-11 18:05:41Safe Bulkers, Inc. has achieved a new 52-week high of USD 4.99, despite a one-year performance decline of 17.41%. With a market cap of USD 456 million, a P/E ratio of 5.00, and a dividend yield of 4.89%, the company shows a balanced financial profile in the transport services industry.

Read full news article

Safe Bulkers, Inc. Hits New 52-Week High of $4.81

2025-11-10 17:11:50Safe Bulkers, Inc. achieved a new 52-week high of USD 4.81 on November 7, 2025, despite a challenging year with a 20.73% decline in stock performance. The company, with a market cap of USD 456 million, maintains a balanced financial structure and offers a dividend yield of 4.89%.

Read full news article

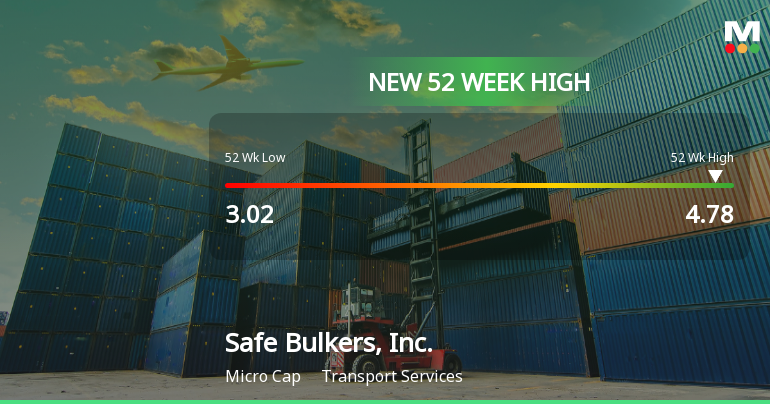

Safe Bulkers, Inc. Hits New 52-Week High of $4.78

2025-11-07 16:03:58Safe Bulkers, Inc. has achieved a new 52-week high of USD 4.78, despite a challenging year marked by a significant decline in stock performance. The company, with a market capitalization of USD 456 million, features a P/E ratio of 5.00 and a dividend yield of 4.89%.

Read full news article