Key Events This Week

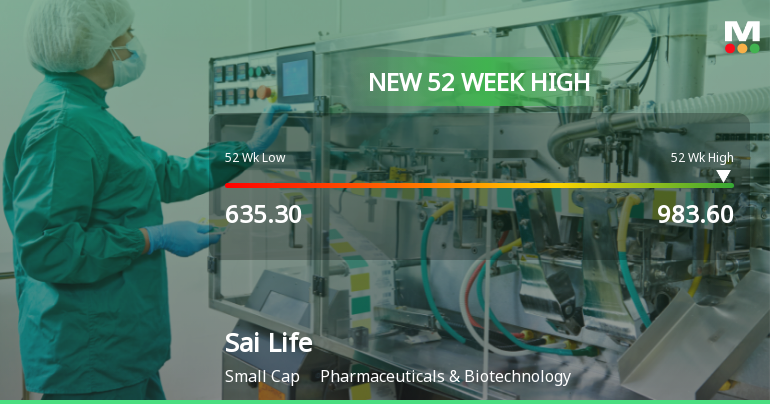

5 Jan: New 52-week high (Rs.965.6) and all-time high (Rs.953.95)

6 Jan: Further 52-week high at Rs.966.15 and all-time high at Rs.972.65

7 Jan: New 52-week and all-time high at Rs.983.6 followed by minor pullback

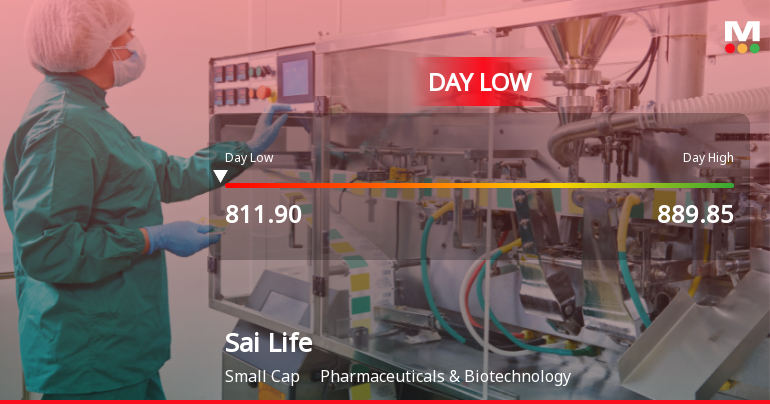

8 Jan: Price decline amid heavy market sell-off

9 Jan: Week closes at Rs.924.30 (-3.74% on day)