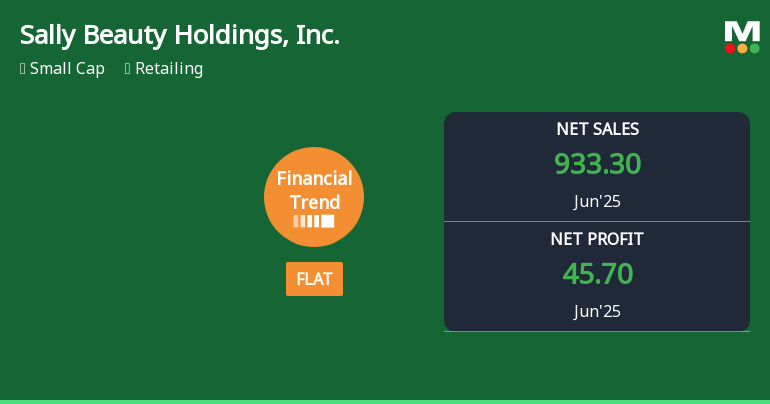

Sally Beauty Holdings, Inc. Experiences Revision in Its Stock Evaluation Amid Mixed Financial Trends

2025-11-20 15:35:00Sally Beauty Holdings, Inc. reported a flat performance for the quarter ending June 2025, showcasing strong operating cash flow of USD 264.62 million and a manageable debt-equity ratio of 183.27%. However, challenges include low inventory and debtors turnover ratios. The company's stock has shown varied returns compared to the S&P 500.

Read full news article

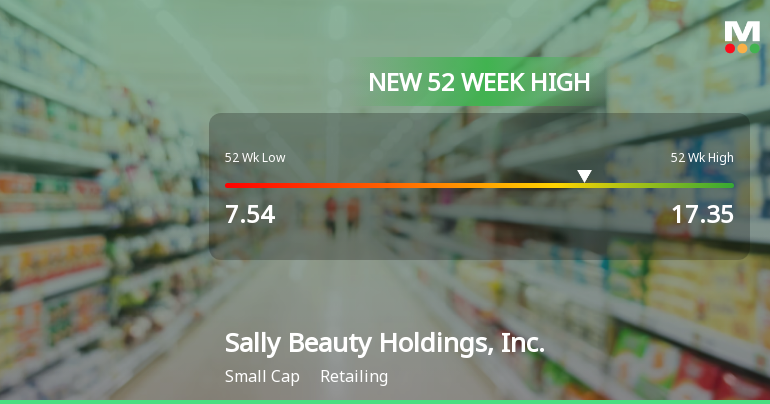

Sally Beauty Holdings Hits New 52-Week High of $17.35

2025-11-14 15:57:05Sally Beauty Holdings, Inc. has achieved a new 52-week high, reflecting its strong performance in the retail sector with a notable annual increase. The company, classified as small-cap, shows effective management with a solid return on equity, despite a moderate debt-to-equity ratio, indicating robust financial health.

Read full news articleNo announcement available

Corporate Actions

No corporate action available