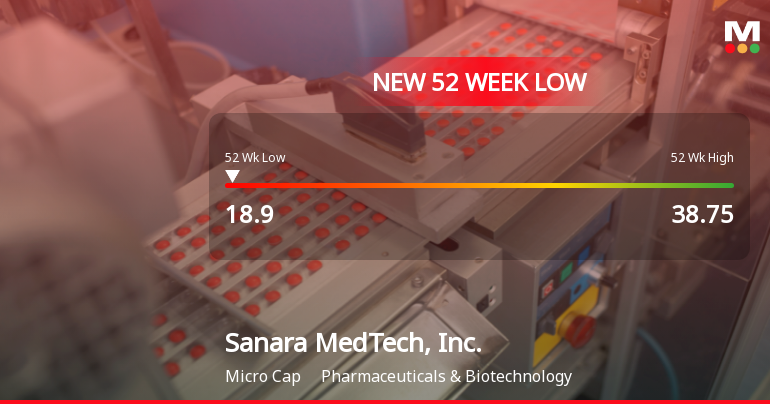

Sanara MedTech, Inc. Hits New 52-Week Low at $18.90

2025-11-21 15:46:12Sanara MedTech, Inc. has reached a new 52-week low, reflecting a significant decline in its stock value over the past year. The company, with a market capitalization of USD 318 million, has faced financial challenges, including consecutive quarterly losses and a negative return on equity.

Read full news article

Sanara MedTech Hits New 52-Week Low at $19.06 Amid Ongoing Struggles

2025-11-20 16:27:49Sanara MedTech, Inc. has reached a new 52-week low, reflecting a significant decline in its stock price over the past year. The company, with a market capitalization of USD 318 million, has faced financial difficulties, including consecutive quarterly losses and a negative return on equity. Its financial metrics indicate ongoing challenges in the biotechnology sector.

Read full news article

Sanara MedTech Hits 52-Week Low at $19.10 Amid Ongoing Struggles

2025-11-14 15:51:56Sanara MedTech, Inc. has reached a new 52-week low, reflecting a difficult year marked by a significant stock price decline. The company, with a market capitalization of USD 318 million, has faced ongoing financial challenges, including consecutive quarterly losses and negative returns on equity and capital employed.

Read full news article

Sanara MedTech Hits 52-Week Low at USD 21.07 Amid Ongoing Struggles

2025-11-13 16:02:16Sanara MedTech, Inc. has reached a new 52-week low, reflecting a difficult year marked by a significant stock price decline. The company, with a market capitalization of USD 318 million, has faced ongoing financial challenges, including consecutive quarterly losses and a negative return on equity, raising concerns about its operational efficiency.

Read full news article