Recent Price Movement and Market Context

The stock’s impressive 10.91% increase on 28-Jan stands out against the broader market, with the Sensex gaining a modest 0.53% over the past week. Schneider Electric Infrastructure Ltd has outperformed its Capital Goods sector peers by 7.86% on the day, signalling strong investor interest. Notably, the stock has been on a two-day winning streak, delivering a 15.56% return in this brief period, underscoring renewed buying enthusiasm.

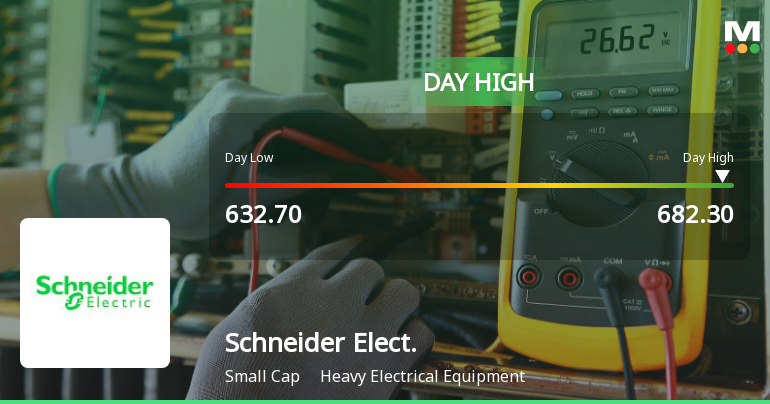

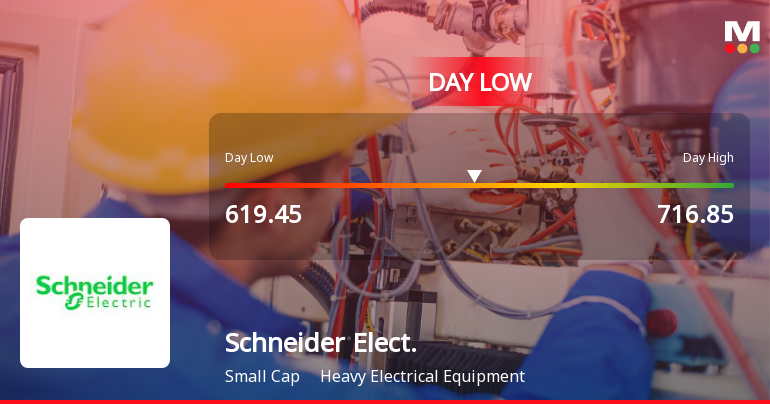

Intraday, the share price touched a high of ₹702.6, marking an 11.05% gain, and traded within a wide range of ₹69.9, indicating heightened volatility and active trading. Despite this, the weighted average price suggests that a larger volume of shares exchanged hands closer to the day’s lower price, h...

Read full news article