Key Events This Week

09 Feb: Q2 FY26 results reveal profitability under pressure

10 Feb: Valuation shifts to very attractive amid mixed market returns

13 Feb: Week closes at Rs.18.00 (+1.41%) outperforming Sensex

Mar 05

BSE+NSE Vol: 205

Seasons Textiles Ltd, a player in the Garments & Apparels sector, has seen its investment rating downgraded from Sell to Strong Sell as of 4 March 2026. Despite an improvement in valuation metrics, the company’s overall financial health and technical indicators have deteriorated, prompting a reassessment of its investment appeal.

Read full news article

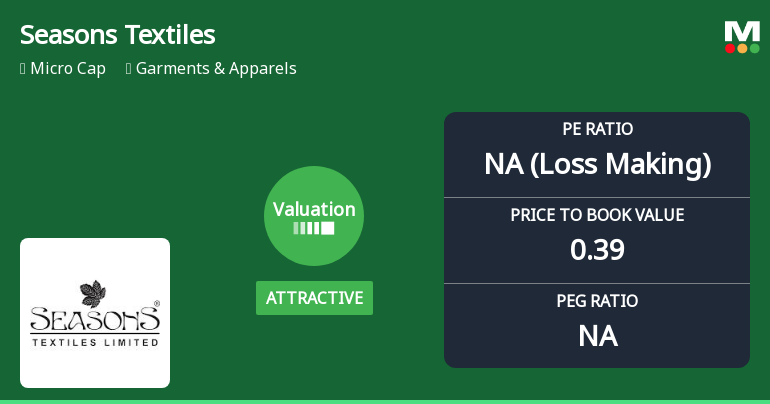

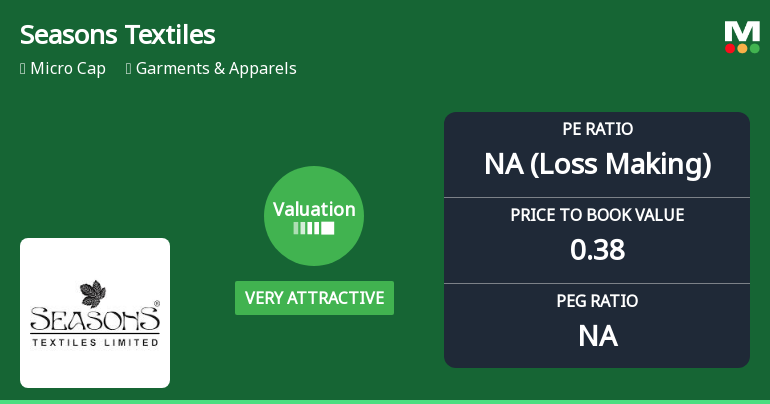

Seasons Textiles Ltd has seen a notable shift in its valuation parameters, moving from a very attractive to an attractive rating, despite ongoing challenges in profitability and returns. This article analyses the recent changes in key valuation metrics such as price-to-earnings (P/E) and price-to-book value (P/BV) ratios, comparing them with historical averages and peer benchmarks to assess the stock’s price attractiveness and investment appeal.

Read full news article

Seasons Textiles Ltd, a player in the Garments & Apparels sector, has seen its investment rating upgraded from Strong Sell to Sell as of 23 February 2026. This change reflects a nuanced shift in the company’s technical outlook despite persistent fundamental challenges. The upgrade is primarily driven by improvements in technical indicators, while valuation and financial trends remain mixed, underscoring a cautious stance for investors.

Read full news article

Seasons Textiles Ltd, a player in the Garments & Apparels sector, has been downgraded from a Sell to a Strong Sell rating as of 18 Feb 2026, reflecting deteriorating technical indicators and persistently weak financial fundamentals. Despite a modest stock return over the past year, the company’s flat recent financial performance, poor long-term growth metrics, and bearish technical trends have prompted a reassessment of its investment appeal.

Read full news article

09 Feb: Q2 FY26 results reveal profitability under pressure

10 Feb: Valuation shifts to very attractive amid mixed market returns

13 Feb: Week closes at Rs.18.00 (+1.41%) outperforming Sensex

Seasons Textiles Ltd has witnessed a significant shift in its valuation parameters, moving from an attractive to a very attractive price range, despite ongoing challenges in profitability and return metrics. This recalibration in valuation metrics, particularly the price-to-earnings (P/E) and price-to-book value (P/BV) ratios, offers investors a nuanced perspective on the stock’s price attractiveness relative to its historical and peer benchmarks within the Garments & Apparels sector.

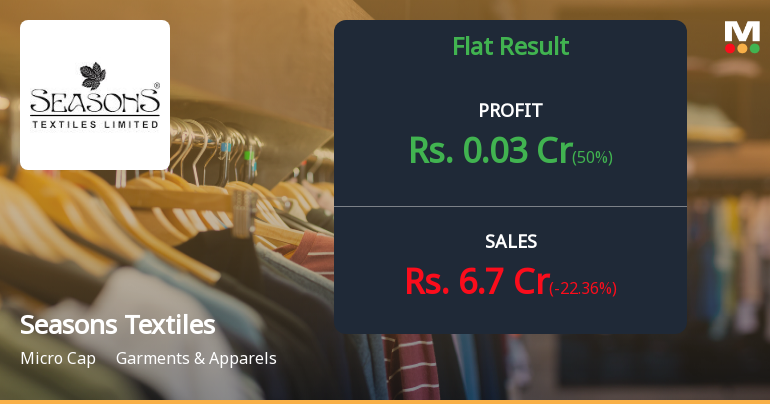

Read full news articleThe latest financial results for Seasons Textiles Ltd indicate significant operational challenges. In Q2 FY26, the company reported net sales of ₹6.70 crores, reflecting a decline of 12.99% quarter-on-quarter and a more pronounced drop of 22.36% year-on-year. This marks the second consecutive quarter of revenue contraction, suggesting persistent difficulties in maintaining market share, particularly in its export markets. Net profit for the same quarter was ₹0.03 crores, which represents a substantial decline of 82.35% compared to the previous quarter. The profit after tax margin also fell to 0.45%, down from 2.21% in Q1 FY26, highlighting the company's struggle to convert operational efficiency into profitability. Operating margins remained relatively stable at 11.19%, but the overall financial performance indicates a precarious position, with cumulative net profit for the first half of FY26 amounting to ...

Read full news article

Seasons Textiles Limited, a Delhi-based manufacturer and exporter of furnishing fabrics, reported marginal net profit of ₹0.03 crores in Q2 FY26, representing an 82.35% decline quarter-on-quarter and a 50.00% increase year-on-year. The micro-cap company with a market capitalisation of ₹14.00 crores continues to grapple with declining revenues and compressed margins, raising serious concerns about its operational viability in an increasingly competitive garments and apparels sector.

Read full news article

Seasons Textiles Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 08 Dec 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 26 December 2025, providing investors with the latest insights into the company’s performance and outlook.

Read full news articlePublication of unaudited Financial Results for the third quarter and Nine months period ended 31 December 2025.

Publication of unaudited Financial Results for the third quarter and Nine months period ended 31 December 2025.

Unaudited Financial Results for the Quarter Ended 31-12-2025

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available