Shri Vasuprada Plantations Ltd is Rated Strong Sell

2026-03-04 10:10:18Shri Vasuprada Plantations Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 20 Oct 2025, reflecting a significant reassessment of the stock’s outlook. However, the analysis and financial metrics presented here are based on the company’s current position as of 04 March 2026, providing investors with the latest insights into its performance and prospects.

Read full news article

Shri Vasuprada Plantations Ltd is Rated Strong Sell

2026-02-21 10:10:18Shri Vasuprada Plantations Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 20 October 2025, reflecting a significant reassessment of the stock’s outlook. However, the analysis and financial metrics presented here are based on the company’s current position as of 21 February 2026, providing investors with the latest data to understand the rationale behind this rating.

Read full news articleAre Shri Vasuprada Plantations Ltd latest results good or bad?

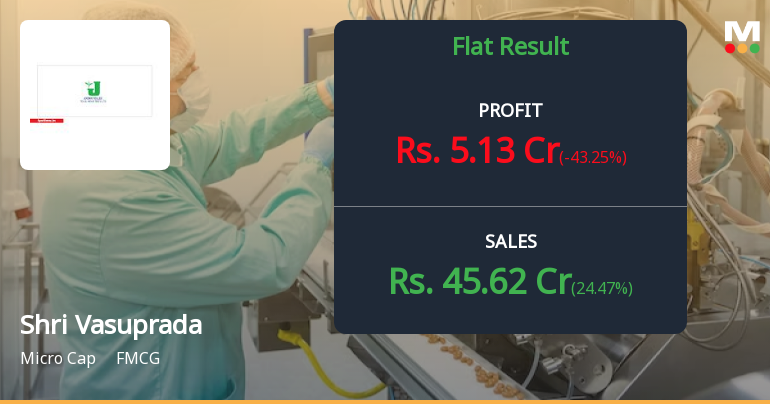

2026-02-13 20:12:09Shri Vasuprada Plantations Ltd's latest financial results present a complex picture. For the quarter ending December 2025, the company reported a revenue of ₹45.62 crores, reflecting a year-on-year growth of 24.47%. This indicates the company's ability to increase its sales despite the challenging conditions within the tea plantation sector. However, the net profit for the same period was ₹5.13 crores, which represents a significant decline of 43.25% compared to the previous year. The operational metrics reveal deeper concerns. The operating margin fell to 6.38%, down from 8.57% in the prior year, indicating a compression in profitability despite the revenue growth. Additionally, the company's reliance on non-operating income, which constituted a substantial portion of its profit before tax, raises questions about the sustainability of its earnings from core operations. Over the first nine months of FY26,...

Read full news article

Shri Vasuprada Plantations Q3 FY26: Profit Swing Masks Deteriorating Core Operations

2026-02-12 18:20:05Shri Vasuprada Plantations Ltd., the Kolkata-based tea plantation company formerly known as Joonktollee Tea Company, reported a net profit of ₹5.13 crores for Q3 FY26 (October-December 2025), a dramatic turnaround from a loss of ₹0.84 crores in the previous quarter. However, this apparent recovery conceals troubling operational realities, as the profit surge was driven almost entirely by non-operating income rather than core tea business performance. The stock, trading at ₹111.85 with a market capitalisation of ₹89.00 crores, has struggled to gain investor confidence, declining 6.52% over the past year whilst the broader market advanced 9.85%.

Read full news article

Shri Vasuprada Plantations Ltd is Rated Strong Sell

2026-02-10 10:10:48Shri Vasuprada Plantations Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 20 October 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 10 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news articleWhen is the next results date for Shri Vasuprada Plantations Ltd?

2026-02-05 23:18:01The next results date for Shri Vasuprada Plantations Ltd is scheduled for 12 February 2026....

Read full news article

Shri Vasuprada Plantations Ltd is Rated Strong Sell

2026-01-30 10:10:35Shri Vasuprada Plantations Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 20 Oct 2025. However, the analysis and financial metrics discussed below reflect the stock’s current position as of 30 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Shri Vasuprada Plantations Ltd is Rated Strong Sell

2026-01-19 10:10:18Shri Vasuprada Plantations Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 20 Oct 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 19 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Shri Vasuprada Plantations Ltd is Rated Strong Sell

2026-01-06 10:10:26Shri Vasuprada Plantations Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 20 Oct 2025, reflecting a reassessment of the stock’s outlook. However, the analysis and financial metrics discussed here represent the company’s current position as of 06 January 2026, providing investors with the latest insights into its performance and prospects.

Read full news articleAnnouncement under Regulation 30 (LODR)-Newspaper Publication

13-Feb-2026 | Source : BSEWe are enclosing herewith newspaper advertisement published on 13th February 2026 in Financial Express in English and Arthik Lipi in Bengali.

Compliances-Reg. 54 - Asset Cover details

12-Feb-2026 | Source : BSESecurity Cover Certificate pursuant to Regulation 54 read with Regulation 56 of the Listing Regulations.

Board Meeting Outcome for Unaudited Financial Results Of The Company For The Quarter And Nine Months Ended December 31 2025

12-Feb-2026 | Source : BSEPursuant to SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 (Listing Regulations) (as amended from time to time) the Board of Directors of the Company at their meeting held today inter-alia considered and approved Standalone and Consolidated Unaudited Financial Results of the Company for the quarter and nine months ended December 31 2025. Accordingly we are enclosing the following: i. The Unaudited Financial Results (Standalone and Consolidated) along with the Limited Review Report for the quarter and nine months ended December 31 2025 as required under Regulation 33 and 52 of the Listing Regulations; ii. Disclosures in accordance with Regulation 52 (4) of the Listing Regulations; iii. Security Cover Certificate pursuant to Regulation 54 read with Regulation 56 of the Listing Regulations. The Board Meeting commenced at 12.15 P.M. and concluded at 14.45 P.M.

Corporate Actions

No Upcoming Board Meetings

Shri Vasuprada Plantations Ltd has declared 5% dividend, ex-date: 23 Aug 18

No Splits history available

No Bonus history available

Shri Vasuprada Plantations Ltd has announced 1:1 rights issue, ex-date: 18 Jan 22