Short-Term Outperformance Against Benchmarks

The stock’s recent price movement demonstrates a significant outperformance relative to the Sensex benchmark. Over the past week, Siddha Ventures has gained 8.91%, while the Sensex declined by 2.55%. Similarly, the one-month return for the stock is a positive 5.09%, contrasting with the Sensex’s 1.29% loss over the same period. Year-to-date, the stock has surged 11.75%, whereas the Sensex has fallen 1.93%. These figures indicate that Siddha Ventures is currently benefiting from momentum that is not reflected in the broader market indices.

Mixed Longer-Term Performance

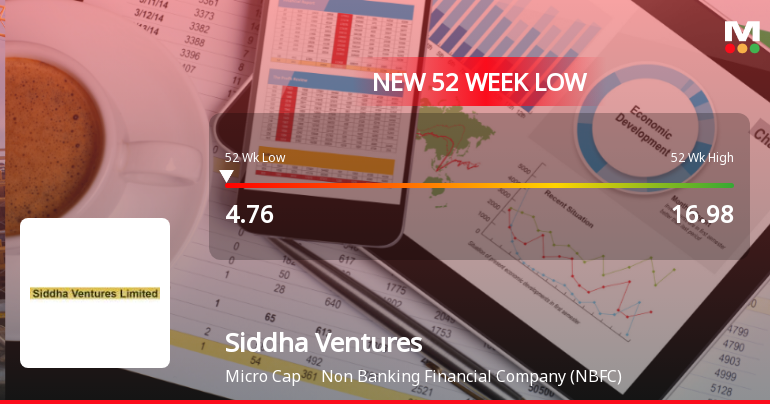

Despite the recent rally, Siddha Ventures’ one-year performance remains deeply negative, with a decline of 53.20%. This contrasts sharp...

Read full news article