Simmonds Marshall Ltd is Rated Sell

2026-03-03 10:10:13Simmonds Marshall Ltd is rated Sell by MarketsMOJO, with this rating last updated on 05 December 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 03 March 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Simmonds Marshall Ltd is Rated Sell

2026-02-20 10:10:06Simmonds Marshall Ltd is rated Sell by MarketsMOJO, with this rating last updated on 05 December 2025. However, the analysis and financial metrics discussed below reflect the company’s current position as of 20 February 2026, providing investors with the latest insights into the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Simmonds Marshall Ltd is Rated Sell

2026-02-09 10:10:04Simmonds Marshall Ltd is rated Sell by MarketsMOJO, with this rating last updated on 05 December 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 09 February 2026, providing investors with an up-to-date view of its fundamentals, valuation, financial trends, and technical outlook.

Read full news article

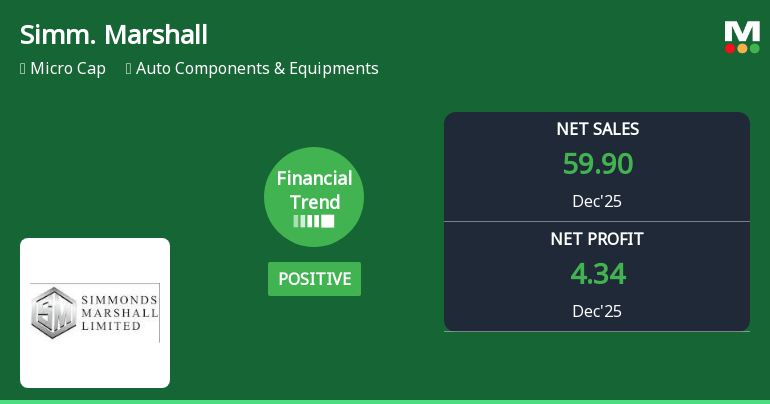

Simmonds Marshall Ltd Reports Positive Quarterly Performance Amid Financial Trend Shift

2026-02-09 08:00:21Simmonds Marshall Ltd, a key player in the Auto Components & Equipments sector, has demonstrated a positive financial performance in the December 2025 quarter, signalling a shift from a previously very positive trend to a more measured positive outlook. Despite a recent downgrade in its Mojo Grade from Hold to Sell, the company posted its highest quarterly revenue and profit metrics in recent history, reflecting resilience amid broader market fluctuations.

Read full news articleAre Simmonds Marshall Ltd latest results good or bad?

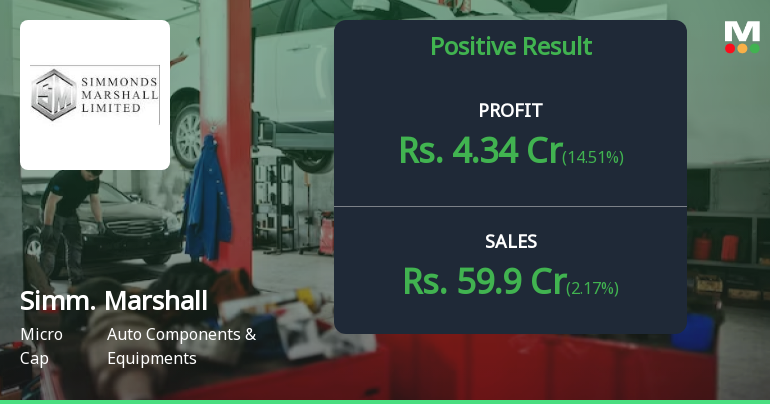

2026-02-06 19:21:34Simmonds Marshall Ltd's latest financial results for Q3 FY26 indicate a notable performance in terms of revenue and profit growth, alongside improvements in operational efficiency. The company reported a net profit of ₹4.34 crores, reflecting a year-on-year increase of 228.79%. Revenue for the quarter reached ₹59.90 crores, marking a 21.67% year-on-year growth and the highest quarterly revenue in at least eight quarters. Additionally, the operating margin expanded to 13.16%, the highest in the same timeframe, showcasing enhanced operational efficiency. Despite these positive developments, there are underlying concerns regarding the company's long-term operational metrics. The average return on capital employed (ROCE) remains low at 3.49%, although the latest figure shows improvement at 14.71%. Similarly, the return on equity (ROE) has improved to 20.72%, yet historically, it has averaged only 6.78%. The co...

Read full news article

Simmonds Marshall Q3 FY26: Strong Profit Surge Masks Underlying Concerns

2026-02-06 17:19:39Simmonds Marshall Limited, a micro-cap auto components manufacturer with a market capitalisation of ₹151.00 crores, reported a striking 228.79% year-on-year surge in net profit to ₹4.34 crores for Q3 FY26 (October-December 2025), up from ₹1.32 crores in the corresponding quarter last year. The sequential growth was equally impressive at 14.51% compared to Q2 FY26's ₹3.79 crores. However, beneath this headline-grabbing performance lies a complex narrative of technical weakness and structural quality concerns that investors cannot afford to ignore.

Read full news article

Simmonds Marshall Ltd is Rated Sell

2026-01-29 10:10:06Simmonds Marshall Ltd is rated Sell by MarketsMOJO, with this rating last updated on 05 Dec 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 29 January 2026, providing investors with the most up-to-date insight into the company’s performance and outlook.

Read full news article

Simmonds Marshall Ltd Forms Death Cross Signalling Bearish Trend

2026-01-09 18:01:42Simmonds Marshall Ltd, a micro-cap player in the Auto Components & Equipments sector, has recently formed a Death Cross, a significant technical indicator where the 50-day moving average crosses below the 200-day moving average. This development signals a potential shift towards a bearish trend, reflecting deteriorating momentum and raising concerns about the stock's medium to long-term outlook.

Read full news article

Simmonds Marshall Ltd is Rated Sell

2026-01-06 10:10:10Simmonds Marshall Ltd is rated Sell by MarketsMOJO. This rating was last updated on 05 December 2025, reflecting a reassessment of the stock’s outlook. However, the analysis and financial metrics discussed here represent the company’s current position as of 06 January 2026, providing investors with the latest insights into its performance and prospects.

Read full news articleShareholder Meeting / Postal Ballot-Scrutinizers Report

13-Feb-2026 | Source : BSESimmonds Marshall Limited has submitted Scrutinizers Report for the postal ballot.

Announcement under Regulation 30 (LODR)-Newspaper Publication

07-Feb-2026 | Source : BSESimmonds Marshall Limited has submitted the Clippings of Newspaper Publication of the Unaudited Financial Results for the Quarter and Nine Months ended December 31 2025.

Board Meeting Outcome for Unaudited Financial Results (Standalone & Consolidated) For The Quarter Ended December 31 2025

06-Feb-2026 | Source : BSESimmonds Marshall Limited has submitted Unaudited Financial Results (Standalone & Consolidated) for the quarter ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

Simmonds Marshall Ltd has declared 25% dividend, ex-date: 05 Sep 19

Simmonds Marshall Ltd has announced 2:10 stock split, ex-date: 29 Mar 10

No Bonus history available

No Rights history available